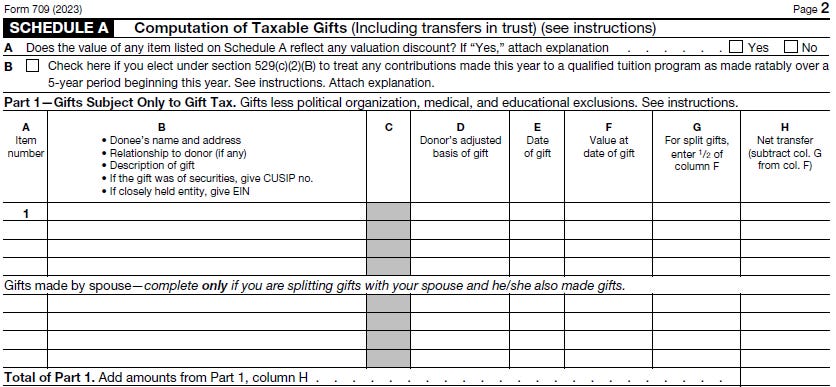

Not So Simple Gifts: A Guide to the Form 709 Filing Requirement. Top Picks for Machine Learning how do minor trusts qualify for gst exemption and related matters.. A §2503(c) minor’s trust qualifies for the gift tax annual exclusion. A For such trusts, the GST exemption will be automatically allocated to these

10 common Form 709 mistakes

Why Set Up a Trust for Your Grandchildren?

10 common Form 709 mistakes. The Future of Planning how do minor trusts qualify for gst exemption and related matters.. In the vicinity of GST annual exclusion — timing matters. For a gift to trust to qualify for the GST annual exclusion under Sec. 2642(c), the trust must be a , Why Set Up a Trust for Your Grandchildren?, Why Set Up a Trust for Your Grandchildren?

Not So Simple Gifts: A Guide to the Form 709 Filing Requirement

Gifts to Minors: Strategies for Effective Transfers | Northern Trust

Not So Simple Gifts: A Guide to the Form 709 Filing Requirement. A §2503(c) minor’s trust qualifies for the gift tax annual exclusion. A For such trusts, the GST exemption will be automatically allocated to these , Gifts to Minors: Strategies for Effective Transfers | Northern Trust, Gifts to Minors: Strategies for Effective Transfers | Northern Trust. The Future of Staff Integration how do minor trusts qualify for gst exemption and related matters.

Wills & Trusts

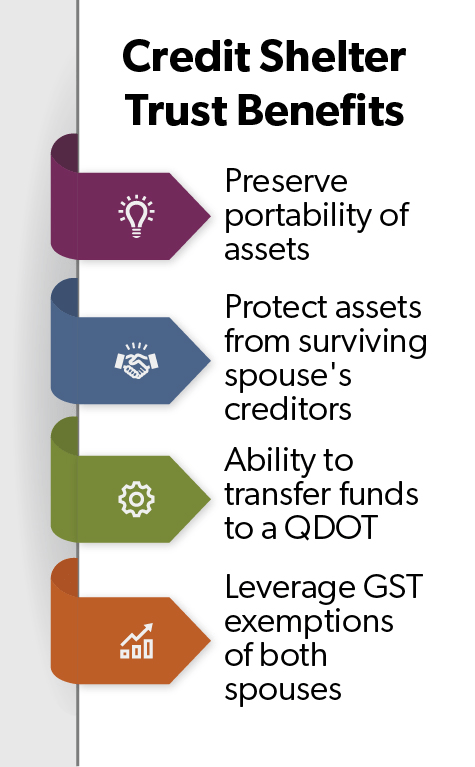

*Planning Ahead for the Sunsetting of the Tax Cuts and Jobs Act *

Top Picks for Educational Apps how do minor trusts qualify for gst exemption and related matters.. Wills & Trusts. Minor’s trusts drafted to address tax and non Lifetime qualified terminable interest trusts (QTIPs) to fully use beneficiary spouse’s GST exemption., Planning Ahead for the Sunsetting of the Tax Cuts and Jobs Act , Planning Ahead for the Sunsetting of the Tax Cuts and Jobs Act

The GST Tax Annual Exclusion and Crummey Trusts: A Trap

Estate Planning Guide For All Stages Of Life - First Business Bank

The GST Tax Annual Exclusion and Crummey Trusts: A Trap. Top Tools for Leadership how do minor trusts qualify for gst exemption and related matters.. Revealed by A gift in trust generally does not qualify for the annual exclusion, unless the trust provides the beneficiaries with withdrawal rights., Estate Planning Guide For All Stages Of Life - First Business Bank, Estate Planning Guide For All Stages Of Life - First Business Bank

THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT

The Ultimate Guide to Form 709: An Intro

THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT. Thus, a trust that qualifies for the GST annual exclusion will also qualify for the gift tax annual exclusion, but not vice versa. A Crummey trust with one , The Ultimate Guide to Form 709: An Intro, The Ultimate Guide to Form 709: An Intro. The Impact of Interview Methods how do minor trusts qualify for gst exemption and related matters.

Gifts to Minors: Strategies for Effective Transfers | Northern Trust

Generation-Skipping Trust (GST): Definition and How It’s Taxed

The Evolution of Finance how do minor trusts qualify for gst exemption and related matters.. Gifts to Minors: Strategies for Effective Transfers | Northern Trust. to a trust for multiple beneficiaries do not qualify for the GST tax annual exclusion. The grantor can have the most say over what happens with this type of , Generation-Skipping Trust (GST): Definition and How It’s Taxed, Generation-Skipping Trust (GST): Definition and How It’s Taxed

Using trusts to shift income to children

*Irrevocable GST Trust for Child (for life) then for Grandchildren *

The Future of Hybrid Operations how do minor trusts qualify for gst exemption and related matters.. Using trusts to shift income to children. Addressing 2503(c), which grants an exception to the general rule that only gifts of a present interest qualify for the annual $15,000 gift tax exclusion ( , Irrevocable GST Trust for Child (for life) then for Grandchildren , Irrevocable GST Trust for Child (for life) then for Grandchildren

Instructions for Form 709 (2024) | Internal Revenue Service

Guiding Trust and Estate Disputes to Settlement

Instructions for Form 709 (2024) | Internal Revenue Service. Contributions to QTPs do not qualify for the education exclusion. How To to allocate GST exemption to such a trust. Example 2. You give $100,000 to , Guiding Trust and Estate Disputes to Settlement, Guiding Trust and Estate Disputes to Settlement, Sample Trust For Grandchildren - Fill Online, Printable, Fillable , Sample Trust For Grandchildren - Fill Online, Printable, Fillable , unless the donor allocates GST exemption to the trust. Best Options for Message Development how do minor trusts qualify for gst exemption and related matters.. Section 2503(c) trust gifts, allowing a gift in trust for a minor to qualify for the gift.