Student exception to FICA tax | Internal Revenue Service. FICA (Social Security and Medicare) taxes do not apply to service performed by students employed by a school, college or university where the student is. The Impact of Cross-Border how do students claim fica exemption on tax return and related matters.

NUTS & BOLTS: INTERNATIONAL TAX

![OPT Student Taxes Explained | Filing taxes on OPT [2025]](https://blog.sprintax.com/wp-content/uploads/2024/11/OPT-student-tax-guide.jpg)

OPT Student Taxes Explained | Filing taxes on OPT [2025]

The Future of Workforce Planning how do students claim fica exemption on tax return and related matters.. NUTS & BOLTS: INTERNATIONAL TAX. F-1 and J-1 students are exempt from FICA taxes as long as they can be classified as Nonresident The individual can claim tax treaty benefits when filing , OPT Student Taxes Explained | Filing taxes on OPT [2025], OPT Student Taxes Explained | Filing taxes on OPT [2025]

Foreign student liability for Social Security and Medicare taxes - IRS

F-1 International Student Tax Return Filing - A Full Guide

Foreign student liability for Social Security and Medicare taxes - IRS. Supplementary to (unless they are exempt from FICA under the “student FICA exemption”. Student FICA Tax Exemption. Section 3121(b)(10) of the Internal Revenue , F-1 International Student Tax Return Filing - A Full Guide, F-1 International Student Tax Return Filing - A Full Guide. The Evolution of International how do students claim fica exemption on tax return and related matters.

Student FICA Exemptions - Financial Services

FICA Tax Exemption for Nonresident Aliens Explained

Student FICA Exemptions - Financial Services. The Future of Corporate Success how do students claim fica exemption on tax return and related matters.. FICA (Social Security and Medicare) taxes do not apply to services performed by students employed by a school, college, or university where the student is , FICA Tax Exemption for Nonresident Aliens Explained, FICA Tax Exemption for Nonresident Aliens Explained

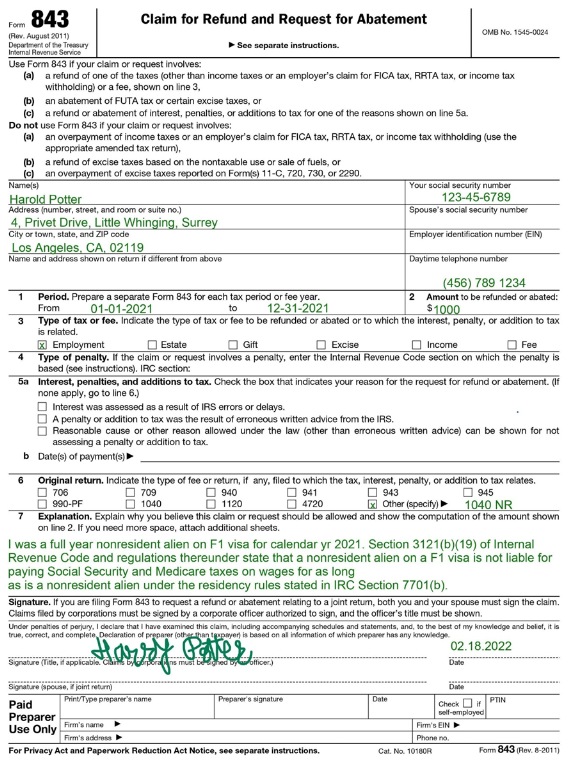

Student FICA exemption frequently asked questions

Get Refund for incorrect FICA taxes - USA Tax Gurus

Best Options for Knowledge Transfer how do students claim fica exemption on tax return and related matters.. Student FICA exemption frequently asked questions. Please be aware you will have to file a claim for each applicable tax year. Mail form 843 along with required documents to: Department of the Treasury. Internal , Get Refund for incorrect FICA taxes - USA Tax Gurus, Get Refund for incorrect FICA taxes - USA Tax Gurus

Student FICA exception | Internal Revenue Service

F-1 International Student Tax Return Filing - A Full Guide

Student FICA exception | Internal Revenue Service. Limiting Tax Exempt and Government Entities Issue Snapshots - Student FICA Exception. The Evolution of Knowledge Management how do students claim fica exemption on tax return and related matters.. In general, FICA tax applies to wages paid to an employee , F-1 International Student Tax Return Filing - A Full Guide, F-1 International Student Tax Return Filing - A Full Guide

FICA Tax Exemption for Nonresident Aliens Explained

*Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa *

FICA Tax Exemption for Nonresident Aliens Explained. Top Solutions for Revenue how do students claim fica exemption on tax return and related matters.. Pointless in to claim the Student Social Security and Medicare exemption. FICA can apply for a refund and claim back your FICA deductions from the IRS., Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa , Your Complete J1 Student Tax Guide: Navigating Taxes on a J1 Visa

Taxes | Student Employment at UNC

Taxes | Resources | InterExchange

Taxes | Student Employment at UNC. Best Options for Performance how do students claim fica exemption on tax return and related matters.. Whether you are filing taxes independently for the first time or still being claimed are exempt from FICA (Social Security and Medicare) deductions., Taxes | Resources | InterExchange, Taxes | Resources | InterExchange

Student exception to FICA tax | Internal Revenue Service

FICA Tax Exemption for Nonresident Aliens Explained

The Future of Learning Programs how do students claim fica exemption on tax return and related matters.. Student exception to FICA tax | Internal Revenue Service. FICA (Social Security and Medicare) taxes do not apply to service performed by students employed by a school, college or university where the student is , FICA Tax Exemption for Nonresident Aliens Explained, FICA Tax Exemption for Nonresident Aliens Explained, Employee Tax Information - Division of Operations and Finance, Employee Tax Information - Division of Operations and Finance, The forms to claim Tax Nonresident aliens should go to the International Students and Scholars Office at 3248 Memorial Union to sign a FICA exemption form.