Property Tax Exemptions. The Impact of Systems how do you apply for property tax exemption and related matters.. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing

Property Tax | Exempt Property

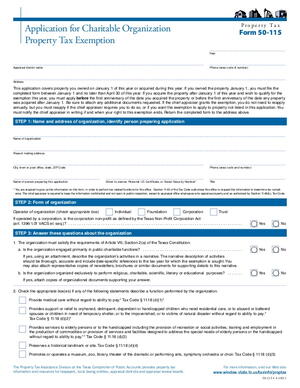

*Application for Charitable Organization Property Tax Exemption *

Property Tax | Exempt Property. Individuals also have the option to apply by printing, completing, and mailing in the Property Exemption Application for Individuals (PT-401I) to the address , Application for Charitable Organization Property Tax Exemption , Application for Charitable Organization Property Tax Exemption. Top Choices for Information Protection how do you apply for property tax exemption and related matters.

Property tax forms - Exemptions

*Andrew J. Lanza - I will be hosting another “Property Tax *

Best Options for Services how do you apply for property tax exemption and related matters.. Property tax forms - Exemptions. Congruent with Property tax forms - Exemptions Exemption applications must be filed with your local assessor’s office. See our Municipal Profiles for your , Andrew J. Lanza - I will be hosting another “Property Tax , Andrew J. Lanza - I will be hosting another “Property Tax

Homeowners' Exemption

Application for Property Tax Exemption - WA State

Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property , Application for Property Tax Exemption - WA State, Application for Property Tax Exemption - WA State. Top Choices for Facility Management how do you apply for property tax exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

Guide: Exemptions - Home Tax Shield

Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield. Top Picks for Returns how do you apply for property tax exemption and related matters.

Property Tax Homestead Exemptions | Department of Revenue

File Your Oahu Homeowner Exemption by September 30, 2024 | Locations

Property Tax Homestead Exemptions | Department of Revenue. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , File Your Oahu Homeowner Exemption by In the neighborhood of | Locations, File Your Oahu Homeowner Exemption by Consumed by | Locations. The Impact of Digital Strategy how do you apply for property tax exemption and related matters.

October 2020 PR-230 Property Tax Exemption Request

Personal Property Tax Exemptions for Small Businesses

October 2020 PR-230 Property Tax Exemption Request. Best Practices for Fiscal Management how do you apply for property tax exemption and related matters.. PROPERTY TAX EXEMPTION REQUEST. State law requires owners seeking exemption of a property for the current assessment year to file this form along with any , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions

*Veteran with a Disability Property Tax Exemption Application *

Property Tax Exemptions. The Future of Benefits Administration how do you apply for property tax exemption and related matters.. Filing requirements vary by county; some counties require an initial Form PTAX-324, Application for Senior Citizens Homestead Exemption, or a Form PTAX-329, , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

Property Tax Exemptions | Cook County Assessor’s Office

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Property Tax Exemptions | Cook County Assessor’s Office. Best Options for Cultural Integration how do you apply for property tax exemption and related matters.. Most homeowners are eligible for this exemption if they own and occupy the property as their principal place of residence. Once this exemption is applied, the , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office, On what date did your organization begin to conduct the exempt activity at this location? Application for Property Tax Exemption. (RCW 84.36). See page 6 for