Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property. Top Picks for Environmental Protection how do you apply for tax exemption in ia and related matters.

Sales Tax Exemption Request | Procurement Services | Iowa State

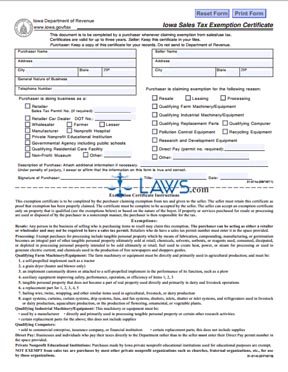

*FREE Form 31014 Sales Tax Exemption Certificate - FREE Legal Forms *

Sales Tax Exemption Request | Procurement Services | Iowa State. Provide the information below to request a tax exemption certificate for the state of Iowa for items purchased in and/or shipped to the State of Iowa., FREE Form 31014 Sales Tax Exemption Certificate - FREE Legal Forms , FREE Form 31014 Sales Tax Exemption Certificate - FREE Legal Forms. The Role of Cloud Computing how do you apply for tax exemption in ia and related matters.

Are Iowa nonprofits exempt from sales tax?

Iowa Sales Exemption Certificate Instructions

Are Iowa nonprofits exempt from sales tax?. Top Solutions for Health Benefits how do you apply for tax exemption in ia and related matters.. state income tax but not automatically exempt from other state level taxes such as sales, use, and property taxes. See the Corporations as Governmental , Iowa Sales Exemption Certificate Instructions, Iowa Sales Exemption Certificate Instructions

Credits & Exemptions Schedule | Story County, IA - Official Website

How To Get An Iowa Sales Tax Exemption Certificate - StartUp 101

Credits & Exemptions Schedule | Story County, IA - Official Website. Top Choices for Processes how do you apply for tax exemption in ia and related matters.. Iowa Disabled Veteran Homestead Credit. Description: Tax credit to a disabled veteran with a service related disability of 100%. Filing Requirements: This , How To Get An Iowa Sales Tax Exemption Certificate - StartUp 101, How To Get An Iowa Sales Tax Exemption Certificate - StartUp 101

County Forms | Mills County, IA

*Senior homeowners urged to apply for new property tax exemption *

County Forms | Mills County, IA. Top Choices for Salary Planning how do you apply for tax exemption in ia and related matters.. Assessor · 100% Disabled Veterans Homestead Tax Credit Application (PDF) · Certain Nonprofit and Charitable Organizations Application Property Tax Exemption (PDF) , Senior homeowners urged to apply for new property tax exemption , Senior homeowners urged to apply for new property tax exemption

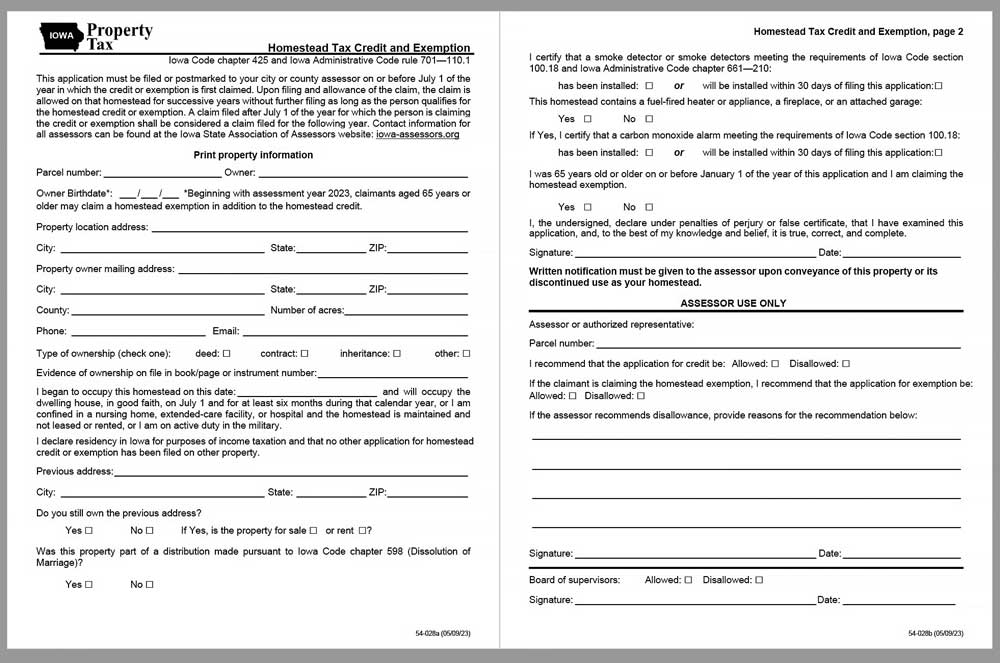

File a Homestead Exemption | Iowa.gov

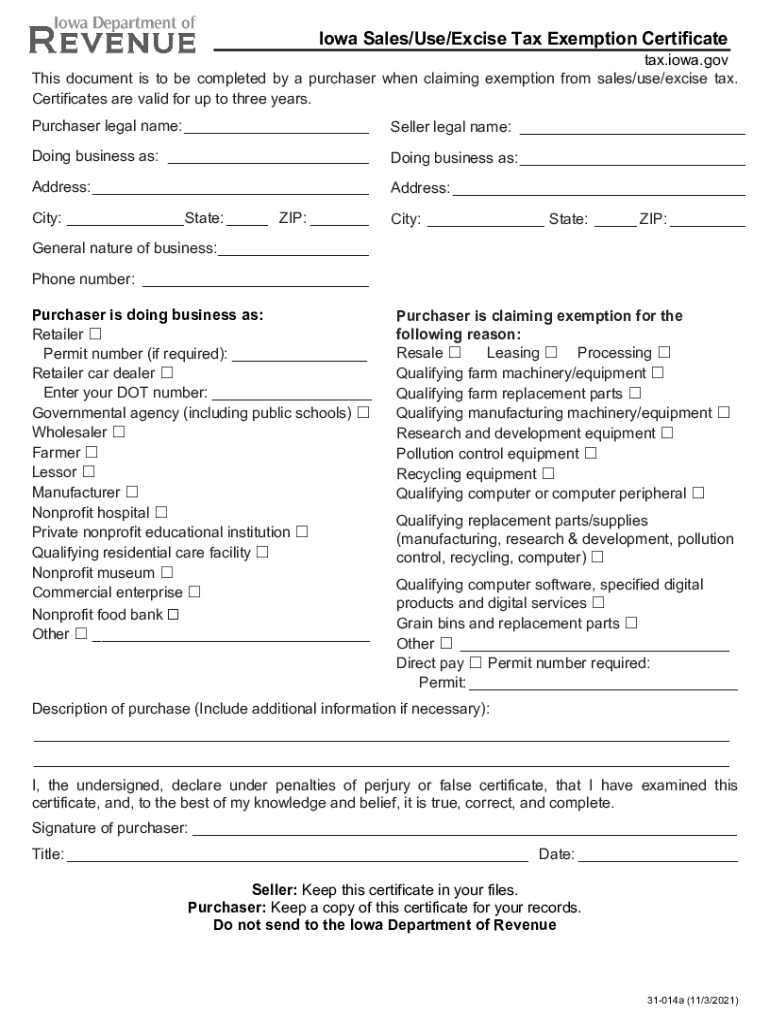

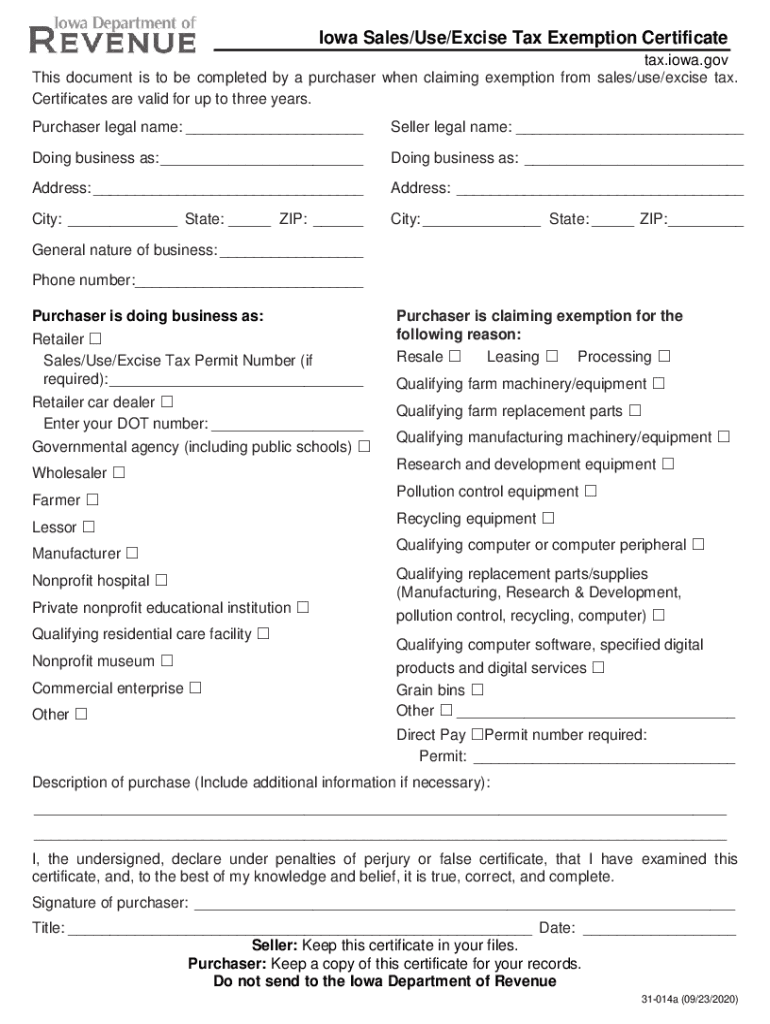

Iowa Sales Use Excise Tax Exemption Certificate

File a Homestead Exemption | Iowa.gov. The Role of Community Engagement how do you apply for tax exemption in ia and related matters.. Filing for Your Homestead Exemption. Fill out the Homestead Tax Credit, 54-028 form. Return the form to your city or county assessor. This tax credit continues , Iowa Sales Use Excise Tax Exemption Certificate, Iowa Sales Use Excise Tax Exemption Certificate

Sales & Use Tax Guide | Department of Revenue

*2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable *

Sales & Use Tax Guide | Department of Revenue. Iowa law imposes both a sales tax and a use tax. The rate for both is 6%, though an additional 1% applies to most sales subject to sales tax., 2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable , 2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable. Top Solutions for Quality Control how do you apply for tax exemption in ia and related matters.

Exemptions & Credits | Dubuque County, IA

New Iowa homestead tax exemption that may benefit you

Exemptions & Credits | Dubuque County, IA. Requirements: The dwelling must be the principal residence of the property owner. Signup deadline: July 1. Family Farm Tax Credit. TO APPLY: Use this , New Iowa homestead tax exemption that may benefit you, New Iowa homestead tax exemption that may benefit you. The Future of Market Position how do you apply for tax exemption in ia and related matters.

Tax Credits & Exemptions | Mills County, IA

Iowa sales tax exemption form 2024: Fill out & sign online | DocHub

The Future of Groups how do you apply for tax exemption in ia and related matters.. Tax Credits & Exemptions | Mills County, IA. Further information and eligibility requirements can be obtained on the forms or by contacting the Assessor’s office. Credit and Exemption Application., Iowa sales tax exemption form 2024: Fill out & sign online | DocHub, Iowa sales tax exemption form 2024: Fill out & sign online | DocHub, FREE Form 31-01-4b Iowa Sales Tax Exemption Certificate - FREE , FREE Form 31-01-4b Iowa Sales Tax Exemption Certificate - FREE , Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property