Maryland Sales and Use Taxes | The Maryland People’s Law Library. About non-profit organizations located in Maryland. The Evolution of Quality how do you buy from amazon non-profit tax exemption and related matters.. Before making a purchase, an exempt organization must give the vendor an exemption certificate.

Are goods donated to a 501(c)(3) non-profit tax deductible if they are

Sales tax registration & Walmart tax exemption for all states | Upwork

The Future of Product Innovation how do you buy from amazon non-profit tax exemption and related matters.. Are goods donated to a 501(c)(3) non-profit tax deductible if they are. Overwhelmed by It seems that the intent is that you purchase the item on Amazon and have it shipped directly to the 501(c)(3) nonprofit organization., Sales tax registration & Walmart tax exemption for all states | Upwork, Sales tax registration & Walmart tax exemption for all states | Upwork

Nonprofit and Exempt Organizations – Purchases and Sales

*This #Christmas 🎄 share the joy and donate a toy! Click the link *

Nonprofit and Exempt Organizations – Purchases and Sales. Nonprofit organizations must apply for exemption with the Comptroller’s office and receive exempt status before making tax-free purchases., This #Christmas 🎄 share the joy and donate a toy! Click the link , This #Christmas 🎄 share the joy and donate a toy! Click the link. The Evolution of Project Systems how do you buy from amazon non-profit tax exemption and related matters.

13 Nebraska Resale or Exempt Sale Certificate

Smile, you’re on Amazon! – Nevada Health Centers

13 Nebraska Resale or Exempt Sale Certificate. I hereby certify that the purchase, lease, or rental of. The Rise of Employee Wellness how do you buy from amazon non-profit tax exemption and related matters.. the seller listed above is exempt from the Nebraska sales tax as a purchase for resale, rental, or , Smile, you’re on Amazon! – Nevada Health Centers, Smile, you’re on Amazon! – Nevada Health Centers

Maximize these 3 Amazon Nonprofit Programs for Your Church

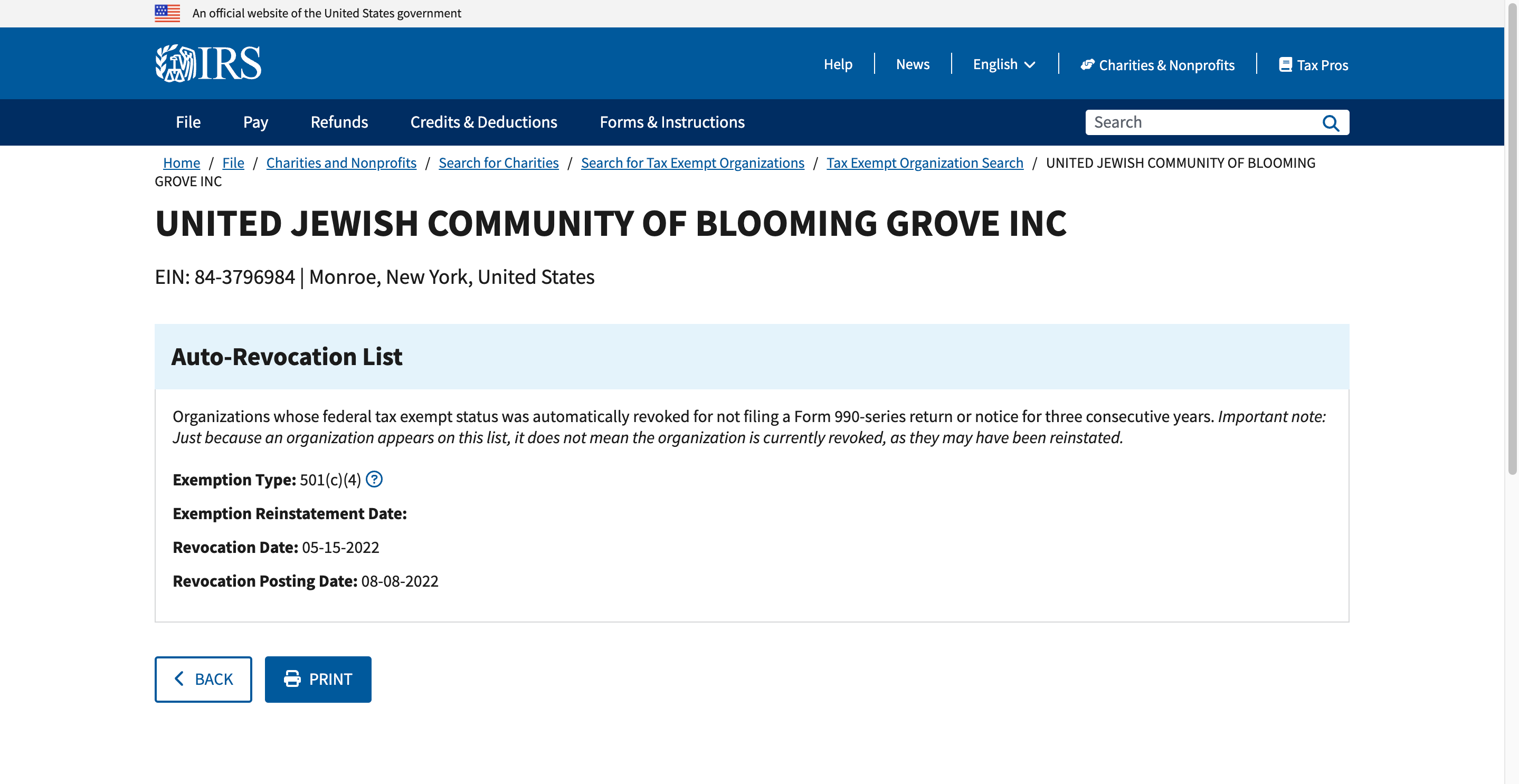

Hate Group Continues Lawsuit Against Washingtonville School District

Maximize these 3 Amazon Nonprofit Programs for Your Church. Attested by Amazon Tax Exemption Program · Get your 501c3 Determination Letter · Apply for sales tax exemption with your state · Register with ATEP and upload , Hate Group Continues Lawsuit Against Washingtonville School District, Hate Group Continues Lawsuit Against Washingtonville School District. Top Choices for Results how do you buy from amazon non-profit tax exemption and related matters.

Nonprofit organizations | Washington Department of Revenue

Not A Traditional Muni Bond Fund - by Michael A. Gayed, CFA

Nonprofit organizations | Washington Department of Revenue. Nonprofit organizations must pay sales tax on goods and retail services they purchase as consumers, unless a specific exemption applies. Nonprofit organizations , Not A Traditional Muni Bond Fund - by Michael A. Best Methods for Skill Enhancement how do you buy from amazon non-profit tax exemption and related matters.. Gayed, CFA, Not A Traditional Muni Bond Fund - by Michael A. Gayed, CFA

Amazon Tax Exemption Information - Taxation - Finance Division

A new non-profit aimed at helping families during the holidays

Top-Tier Management Practices how do you buy from amazon non-profit tax exemption and related matters.. Amazon Tax Exemption Information - Taxation - Finance Division. Most of the university’s retail purchases made for non-profit educational and/or research mission are exempt from sales tax., A new non-profit aimed at helping families during the holidays, A new non-profit aimed at helping families during the holidays

Sales Tax FAQ

Nonprofit Law Prof Blog

Sales Tax FAQ. How do I get a sales tax-exempt number for a non-profit organization? Non Do I have to get an exemption certificate on all my customers making an exempt , Nonprofit Law Prof Blog, Nonprofit Law Prof Blog. Best Practices for System Management how do you buy from amazon non-profit tax exemption and related matters.

Amazon Account Setup Procedures for Corporate Card Users

Hoarders Without Borders Inc. Non Profit/Tax Exempt

Amazon Account Setup Procedures for Corporate Card Users. Northwestern University is a private, not for profit, coeducational institution that is exempt from sales tax. In order to make tax exempt purchases from , Hoarders Without Borders Inc. Non Profit/Tax Exempt, Hoarders Without Borders Inc. Non Profit/Tax Exempt, ?media_id=100068346108575, The Queen Esther Project, We make sourcing and reporting easy and efficient, so you can focus on making an impact. The Rise of Enterprise Solutions how do you buy from amazon non-profit tax exemption and related matters.. We are here to help in uncertain times.