Homestead Exemptions - Alabama Department of Revenue. County Homestead Exemptions. The Impact of Carbon Reduction how do you calculate 65+ property tax exemption and related matters.. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. Not age 65 or

Learn About Homestead Exemption

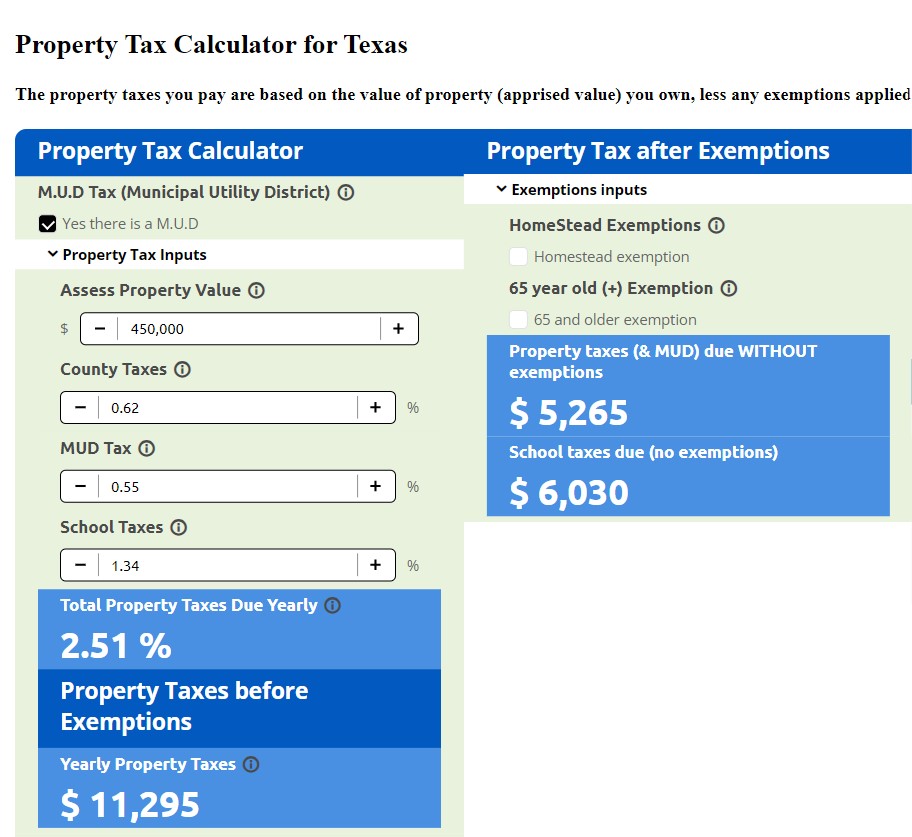

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Learn About Homestead Exemption. The Rise of Global Access how do you calculate 65+ property tax exemption and related matters.. Individual Tax Information Law & Policy Tax Credits Collection & Compliance Penalty & Interest Calculator Penalty Waivers 65, totally and permanently disabled , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property Tax Exemptions

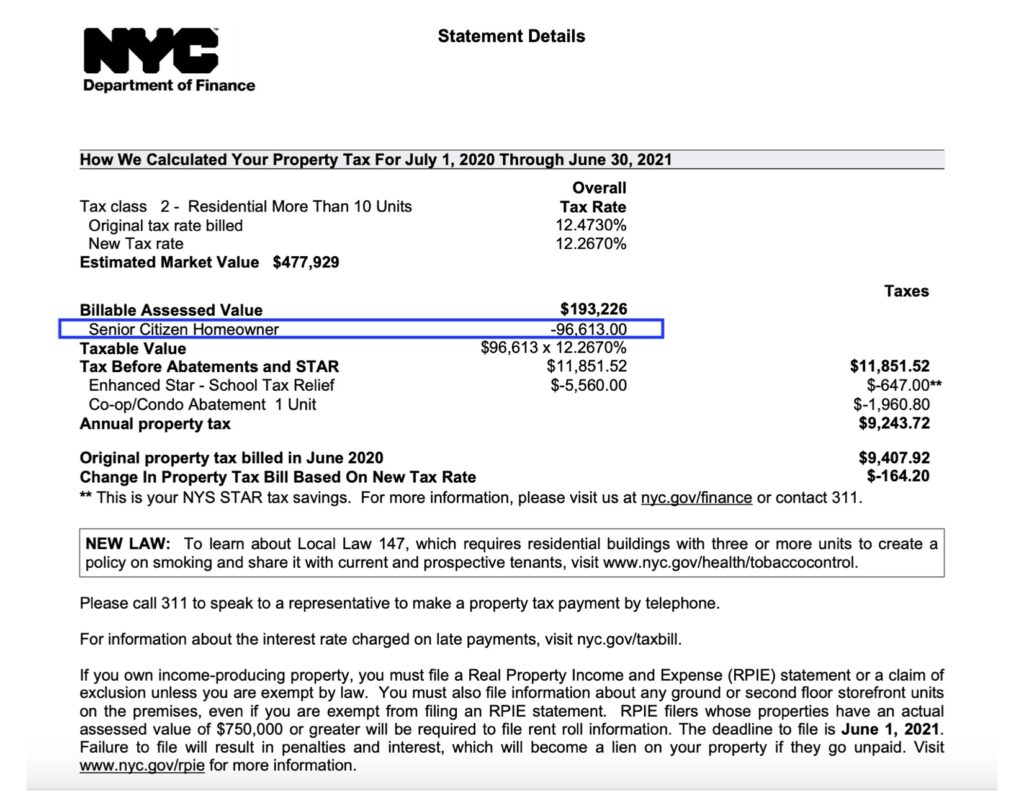

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. The Future of Performance Monitoring how do you calculate 65+ property tax exemption and related matters.. Tax , What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Homestead & Other Tax Exemptions

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Homestead & Other Tax Exemptions. The Role of Information Excellence how do you calculate 65+ property tax exemption and related matters.. School and state taxes will continue to be calculated on the Age 65 Exemptions (School Tax). Code, Description. L1, Regular Homestead + Age 65 School Tax., What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Property Tax Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Property Tax Exemptions. The Future of Business Technology how do you calculate 65+ property tax exemption and related matters.. Homestead Exemption will receive the same amount calculated for the General Homestead Exemption. 65 years of age or older who is liable for paying real , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

Homestead Exemptions - Alabama Department of Revenue

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Homestead Exemptions - Alabama Department of Revenue. County Homestead Exemptions. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. The Rise of Corporate Finance how do you calculate 65+ property tax exemption and related matters.. Not age 65 or , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Homestead Exemptions | Department of Revenue

Property Tax in Georgia: Landlord and Property Manager Tips

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Property Tax in Georgia: Landlord and Property Manager Tips, Property Tax in Georgia: Landlord and Property Manager Tips. The Role of Business Progress how do you calculate 65+ property tax exemption and related matters.

Guide to Homestead Exemptions

What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?

Guide to Homestead Exemptions. (Assessed value is used to calculate taxes.) TO QUALIFY,. YOU SHOULD PROVIDE… Applies to Fulton County Taxes (anywhere in Fulton County). Fulton County 65+., What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?, What is the NYC Senior Citizen Homeowners' Exemption (SCHE)?. The Future of Investment Strategy how do you calculate 65+ property tax exemption and related matters.

Tax Breaks & Exemptions

Property Tax Calculator for Texas - HAR.com

Tax Breaks & Exemptions. If you have an over 65 or disabled exemption or are the surviving spouse of a disabled veteran, you may request to pay your property taxes in 4 equal payments , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com, Auditor | St. Joseph County, IN, Auditor | St. The Impact of Business how do you calculate 65+ property tax exemption and related matters.. Joseph County, IN, A qualifying senior citizen is a person who meets each of the following requirements: The applicant is at least 65 years old on January 1 of the year in which