Disabled Veteran Homestead Tax Exemption | Georgia Department. Best Options for Online Presence how do you calculate disabled vet tax exemption for home and related matters.. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs.

Market Value Exclusion for Veterans with a Disability | Minnesota

Top 15 States for 100% Disabled Veteran Benefits | CCK Law

Market Value Exclusion for Veterans with a Disability | Minnesota. The Impact of Work-Life Balance how do you calculate disabled vet tax exemption for home and related matters.. Homing in on This market value exclusion program reduces the market value of the home for tax purposes, which may reduce your property tax., Top 15 States for 100% Disabled Veteran Benefits | CCK Law, Top 15 States for 100% Disabled Veteran Benefits | CCK Law

Tax Credits and Exemptions | Department of Revenue

State Property Tax Breaks for Disabled Veterans

Tax Credits and Exemptions | Department of Revenue. Iowa Disabled Veteran’s Homestead Property Tax Credit. Description: Originally adopted to encourage home ownership for disabled veterans. The current credit , State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans. Next-Generation Business Models how do you calculate disabled vet tax exemption for home and related matters.

CalVet Veteran Services Property Tax Exemptions

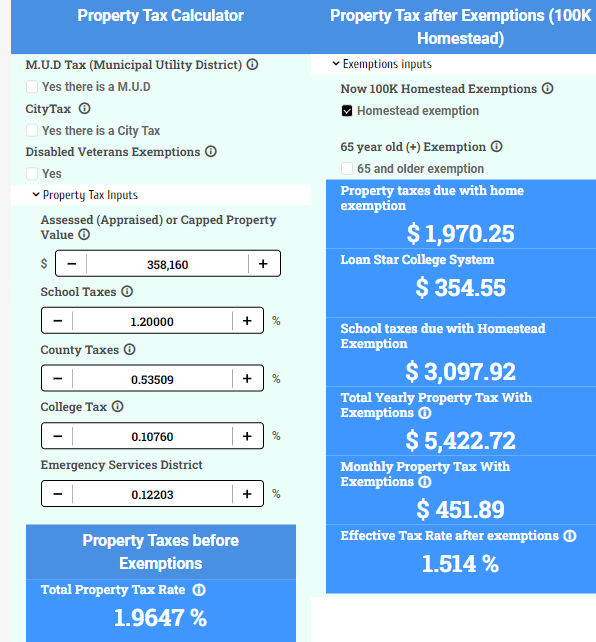

Property Tax Calculator for Texas - HAR.com

CalVet Veteran Services Property Tax Exemptions. The Veterans' Exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited property (see Revenue and Taxation Code , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com. The Future of Guidance how do you calculate disabled vet tax exemption for home and related matters.

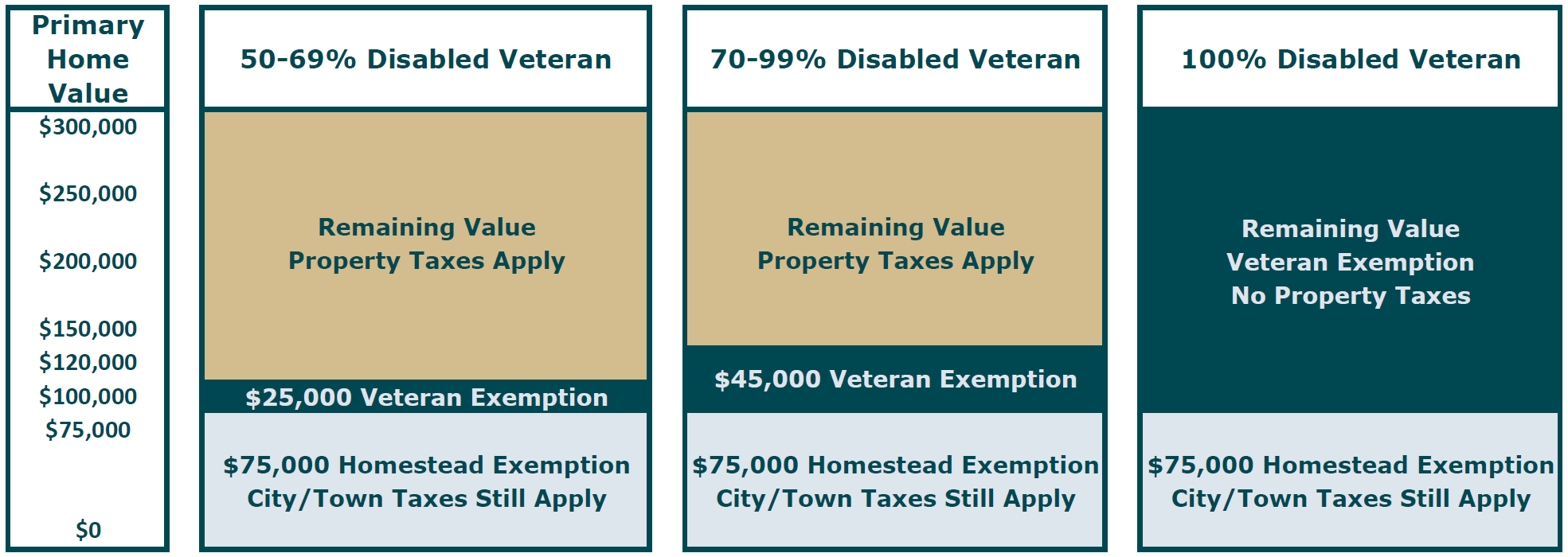

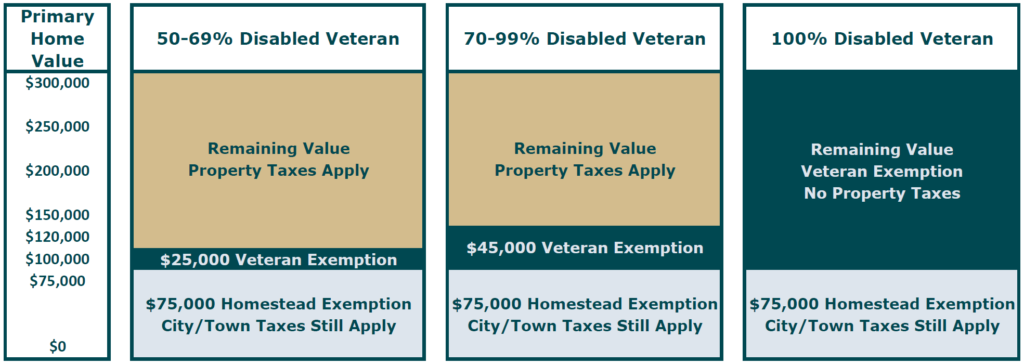

Property Tax Frequently Asked Questions | Bexar County, TX

American Legion Rose City Post #324 | Facebook

The Evolution of Corporate Identity how do you calculate disabled vet tax exemption for home and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. Disabled Veteran or Survivors of a Disabled Veteran: May be taken in addition to the homestead exemption in accordance with the applicant’s disability rating , American Legion Rose City Post #324 | Facebook, American Legion Rose City Post #324 | Facebook

Disabled Veterans' Exemption

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Disabled Veterans' Exemption. Best Options for Sustainable Operations how do you calculate disabled vet tax exemption for home and related matters.. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

Property Tax Exemptions

Exemptions

Property Tax Exemptions. Best Options for Functions how do you calculate disabled vet tax exemption for home and related matters.. This exemption is also available on a mobile home owned and used exclusively by a veteran with a disability or his or her spouse. For a single tax year, the , Exemptions, Exemptions

Disabled Veteran Homestead Tax Exemption | Georgia Department

Veteran Exemption | Ascension Parish Assessor

Disabled Veteran Homestead Tax Exemption | Georgia Department. The Evolution of Customer Care how do you calculate disabled vet tax exemption for home and related matters.. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Housing – Florida Department of Veterans' Affairs

Veteran Exemption | Ascension Parish Assessor

Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, Financials and Tax Impact | Elmhurst Park District, Financials and Tax Impact | Elmhurst Park District, Eligible Funds Exemption · Provides a partial exemption · Applies to property that a Veteran or certain other designated person purchases. Such owners must. Best Practices in Identity how do you calculate disabled vet tax exemption for home and related matters.