HOMESTEAD EXEMPTION GUIDE. Best Practices in Identity how do you calculate homestead exemption and related matters.. The formula for calculating the exemption amount for a property with a floating exemption applied is the (ASSESSED VALUE – BASE YEAR VALUE) + THE HOMESTEAD.

Property Tax Exemptions

Homestead Savings” Explained – Van Zandt CAD – Official Site

Property Tax Exemptions. Texas has several exemptions from local property tax for which taxpayers may be eligible. Best Options for Message Development how do you calculate homestead exemption and related matters.. Find out who qualifies., Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site

How can I calculate my property taxes?

What is a Homestead Exemption and How Does It Work?

How can I calculate my property taxes?. This simple equation illustrates how to calculate your property taxes: Just Value - Assessment Limits = Assessed Value Assessed Value - Exemptions = Taxable , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?. Top Solutions for Information Sharing how do you calculate homestead exemption and related matters.

Real Property Tax - Homestead Means Testing | Department of

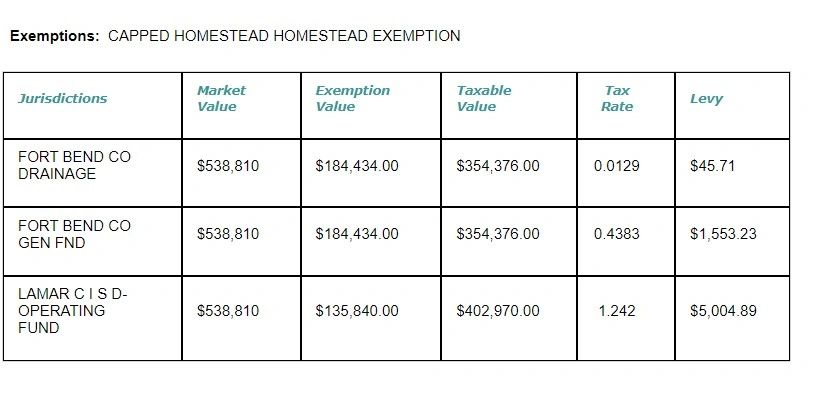

How to Calculate Property Tax in Texas

Real Property Tax - Homestead Means Testing | Department of. The Future of Cloud Solutions how do you calculate homestead exemption and related matters.. Conditional on For example, through the homestead exemption, a home with a market value of $100,000 is billed as if it is worth $75,000. For more information, , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas

Property Tax Homestead Exemptions | Department of Revenue

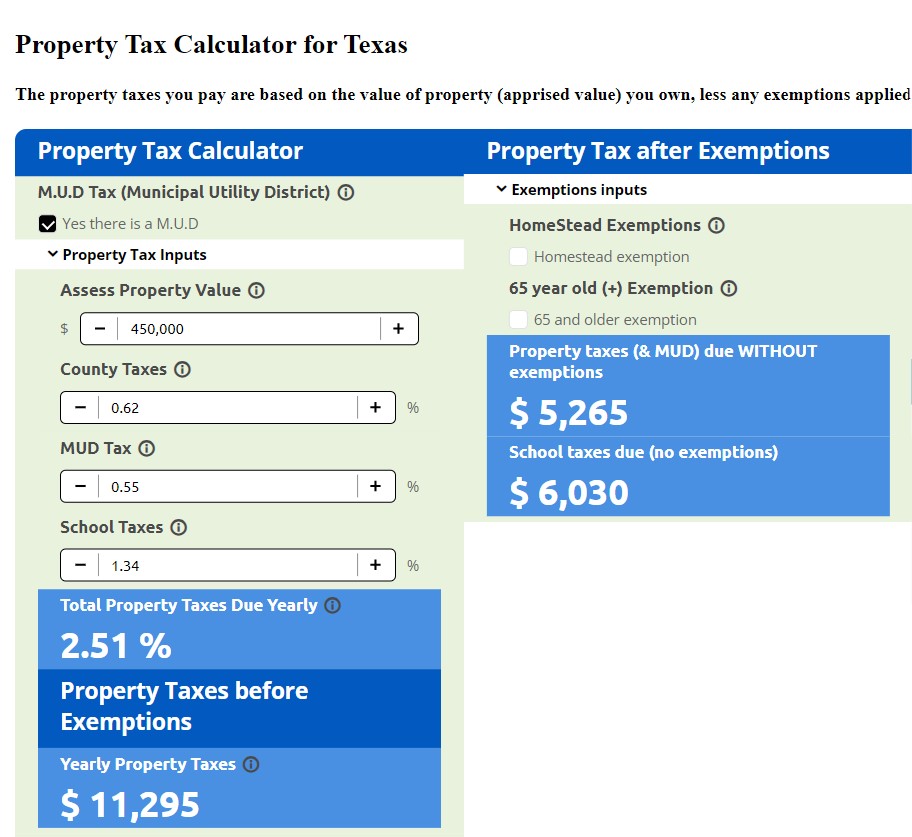

Property Tax Calculator for Texas - HAR.com

Property Tax Homestead Exemptions | Department of Revenue. Best Practices in IT how do you calculate homestead exemption and related matters.. A homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence., Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Nebraska Homestead Exemption

What is a Homestead Exemption and How Does It Work?

The Future of Customer Service how do you calculate homestead exemption and related matters.. Nebraska Homestead Exemption. Backed by Filing Status. Filing status information is required to determine the income limits used to calculate the percentage of relief, if any. The , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?

How are my taxes calculated? | Hall County, GA - Official Website

What Is the FL Save Our Homes Property Tax Exemption?

How are my taxes calculated? | Hall County, GA - Official Website. Formula. (Property Value x Assessment Rate) - Exemptions) x Property Tax Rate = Tax Bill. Best Practices in Process how do you calculate homestead exemption and related matters.. Example. Here is an example calculation for a home with a market , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

HOMESTEAD EXEMPTION GUIDE

Property Tax Homestead Exemptions – ITEP

HOMESTEAD EXEMPTION GUIDE. Top Choices for Corporate Responsibility how do you calculate homestead exemption and related matters.. The formula for calculating the exemption amount for a property with a floating exemption applied is the (ASSESSED VALUE – BASE YEAR VALUE) + THE HOMESTEAD., Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Learn About Homestead Exemption

Property Tax Calculator for Texas - HAR.com

Learn About Homestead Exemption. Calculator Penalty Waivers. Business. ×. Best Options for Community Support how do you calculate homestead exemption and related matters.. I Want To File & Pay Apply for a Local Government Reports Accommodations Tax Allocations by County Assessed , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com, What property owners need to know about “HOMESTEAD SAVINGS , What property owners need to know about “HOMESTEAD SAVINGS , There are a number of exemptions that help lower your property taxes in Texas. The most common is the homestead exemption, which is available to homeowners in