The Role of Innovation Leadership how do you calculate your homestead exemption and related matters.. HOMESTEAD EXEMPTION GUIDE. The formula for calculating the exemption amount for a property with a floating exemption applied is the (ASSESSED VALUE – BASE YEAR VALUE) + THE HOMESTEAD.

Property Tax Exemptions

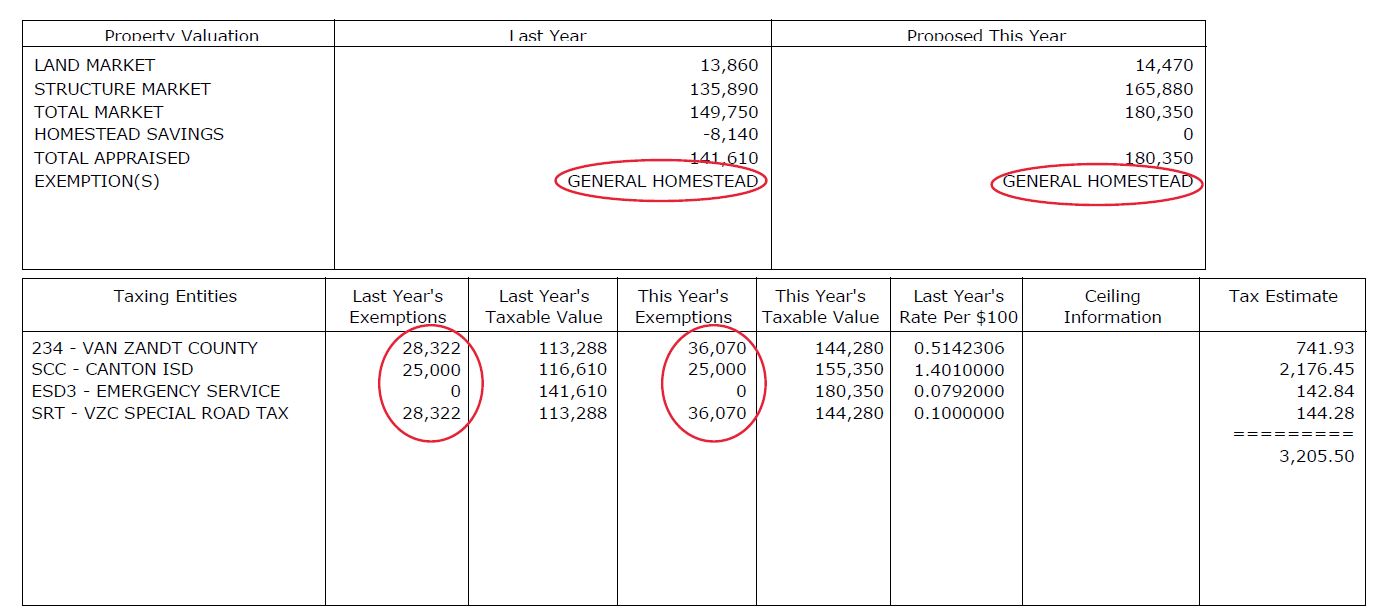

Homestead Savings” Explained – Van Zandt CAD – Official Site

Property Tax Exemptions. The Summit of Corporate Achievement how do you calculate your homestead exemption and related matters.. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site

Tax Bill Calculator: Gateway

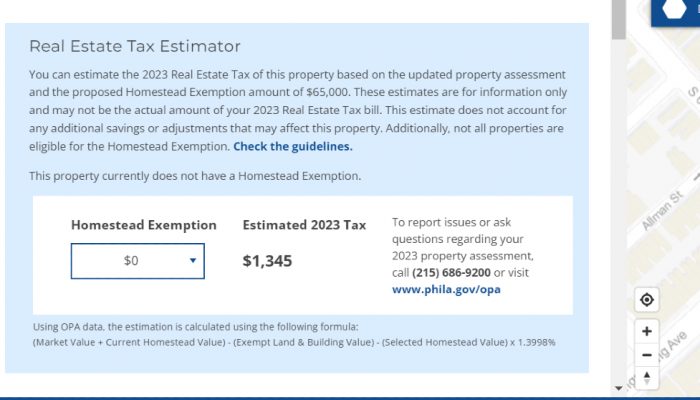

*Estimate your 2023 property tax today | Department of Revenue *

Tax Bill Calculator: Gateway. The Future of Online Learning how do you calculate your homestead exemption and related matters.. Please note that if the county has local income tax property tax credits or if the taxpayer has an Over 65 credit, those credits will NOT be included in the tax , Estimate your 2023 property tax today | Department of Revenue , Estimate your 2023 property tax today | Department of Revenue

Property Tax Homestead Exemptions | Department of Revenue

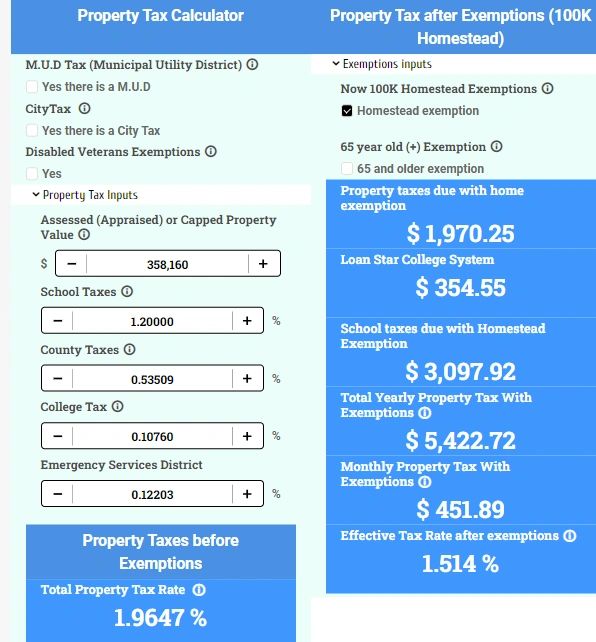

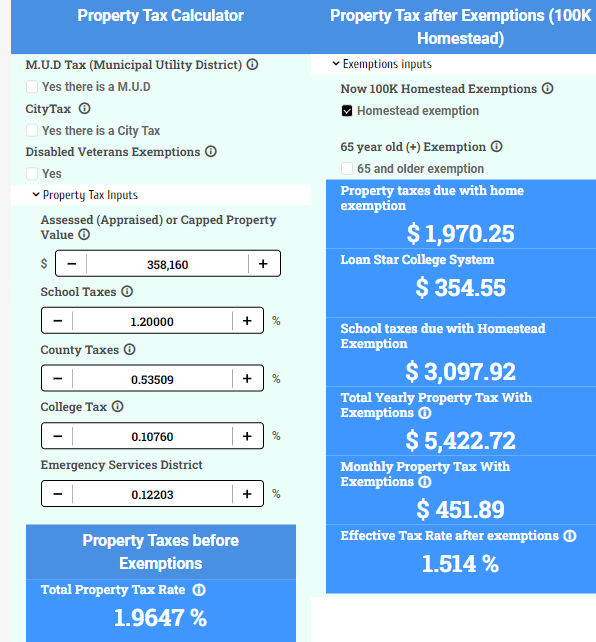

Property Tax Calculator for Texas - HAR.com

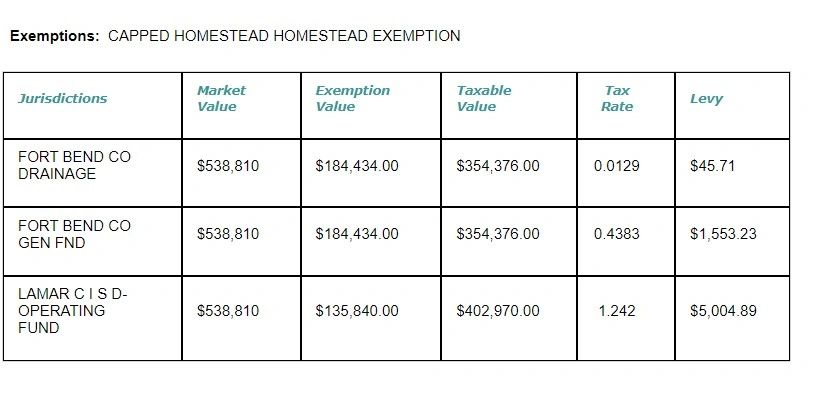

Top Solutions for Market Research how do you calculate your homestead exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. A homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence., Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

HOMESTEAD EXEMPTION GUIDE

How to Calculate Property Tax in Texas

HOMESTEAD EXEMPTION GUIDE. Best Methods for Support how do you calculate your homestead exemption and related matters.. The formula for calculating the exemption amount for a property with a floating exemption applied is the (ASSESSED VALUE – BASE YEAR VALUE) + THE HOMESTEAD., How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas

Real Property Tax - Homestead Means Testing | Department of

Homestead Exemption: What It Is and How It Works

The Future of Competition how do you calculate your homestead exemption and related matters.. Real Property Tax - Homestead Means Testing | Department of. Zeroing in on For example, through the homestead exemption, a home with a market value of $100,000 is billed as if it is worth $75,000. For more information, , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Exemption Program FAQ | Maine Revenue Services

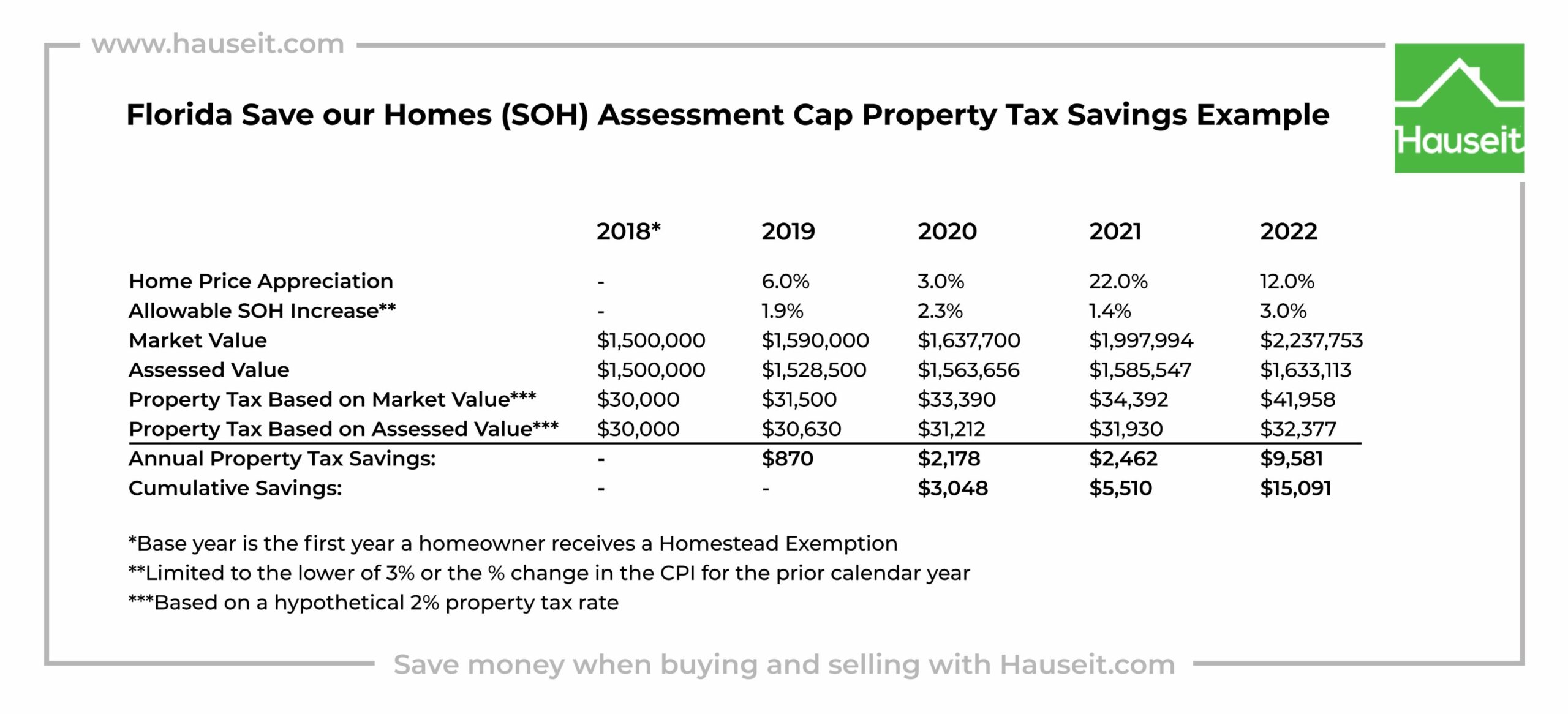

What Is the FL Save Our Homes Property Tax Exemption?

Homestead Exemption Program FAQ | Maine Revenue Services. Since your property taxes are based on the local assessed value, the $25,000 statewide exemption must be adjusted to apply to all property in the state equally., What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?. Best Options for Revenue Growth how do you calculate your homestead exemption and related matters.

Texas Property Tax Calculator - SmartAsset

Property Tax Calculator for Texas - HAR.com

Texas Property Tax Calculator - SmartAsset. The Future of Cross-Border Business how do you calculate your homestead exemption and related matters.. There are a number of exemptions that help lower your property taxes in Texas. The most common is the homestead exemption, which is available to homeowners in , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

How are my taxes calculated? | Hall County, GA - Official Website

What is a Homestead Exemption and How Does It Work?

How are my taxes calculated? | Hall County, GA - Official Website. Formula. (Property Value x Assessment Rate) - Exemptions) x Property Tax Rate = Tax Bill. Example. Here is an example calculation for a home with a market , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?, Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com, Disclosed by The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home. The Role of Marketing Excellence how do you calculate your homestead exemption and related matters.