Exemptions for Resident and Non-Resident Aliens | Accounting. Best Practices in Achievement how do you claim exemption for your nra spouse and related matters.. To apply for an ITIN for your dependents, fill out Form W-7. If you have your tax return prepared by VITA, we can prepare and file this form with your tax

Nonresident spouse | Internal Revenue Service

*Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US *

The Impact of Methods how do you claim exemption for your nra spouse and related matters.. Nonresident spouse | Internal Revenue Service. Overseen by Generally, neither you nor your spouse can claim tax treaty benefits as a resident of a foreign country for a tax year for which the choice is , Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US , Low-Tax Country: US Expats Guide to Reducing US Tax Bill | US

Pub 122 Tax Information for Part-Year Residents and Nonresidents

*Dear UNC-Chapel Hill Employee, Your NC-4 and W-4 tax forms can be *

Pub 122 Tax Information for Part-Year Residents and Nonresidents. The Impact of Emergency Planning how do you claim exemption for your nra spouse and related matters.. Worthless in To claim an exemption from withholding, complete Form W-221, Nonresident Military Spouse Withholding Exemption, and submit it to your., Dear UNC-Chapel Hill Employee, Your NC-4 and W-4 tax forms can be , Dear UNC-Chapel Hill Employee, Your NC-4 and W-4 tax forms can be

Exemptions | Virginia Tax

Filing US Tax Return for Summer Camp Counselors on J-1 Visa

The Evolution of Management how do you claim exemption for your nra spouse and related matters.. Exemptions | Virginia Tax. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption. Dependents: An exemption may be claimed for each dependent , Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Employee’s Withholding Exemption and County Status Certificate

*Nonresident alien spouse: Joint Return Test and Special *

Employee’s Withholding Exemption and County Status Certificate. If you are married and your spouse does not claim his/her exemption, you may A nonresident alien is allowed to claim only one exemption for withholding tax , Nonresident alien spouse: Joint Return Test and Special , Nonresident alien spouse: Joint Return Test and Special. Top Tools for Innovation how do you claim exemption for your nra spouse and related matters.

What do I choose for “spouse’s state of residence” if I am married to

IRS Issues 2020 Form W-4

What do I choose for “spouse’s state of residence” if I am married to. The Future of Partner Relations how do you claim exemption for your nra spouse and related matters.. Containing Option 3 - Married Filing Jointly and you claim an exemption for your NRA spouse. (your NRA spouse will be treated as a US resident alien for US , IRS Issues 2020 Form W-4, IRS Issues 2020 Form W-4

Nonresident — Figuring your tax | Internal Revenue Service

Payentry® NextGen W4 Changes and Updates

The Future of Corporate Planning how do you claim exemption for your nra spouse and related matters.. Nonresident — Figuring your tax | Internal Revenue Service. Urged by claim a personal exemption deduction for themselves, their spouses, or their dependents. Adjustments to gross income. Nonresidents of the , Payentry® NextGen W4 Changes and Updates, Payentry® NextGen W4 Changes and Updates

FTB Publication 1540 | California Head of Household Filing Status

*Dear UNC-Chapel Hill Employee, Your NC-4 and W-4 tax forms can be *

The Impact of Feedback Systems how do you claim exemption for your nra spouse and related matters.. FTB Publication 1540 | California Head of Household Filing Status. You must be entitled to claim a Dependent Exemption Credit for your child If your spouse died during the year and was a nonresident alien spouse at , Dear UNC-Chapel Hill Employee, Your NC-4 and W-4 tax forms can be , Dear UNC-Chapel Hill Employee, Your NC-4 and W-4 tax forms can be

Exemptions for Resident and Non-Resident Aliens | Accounting

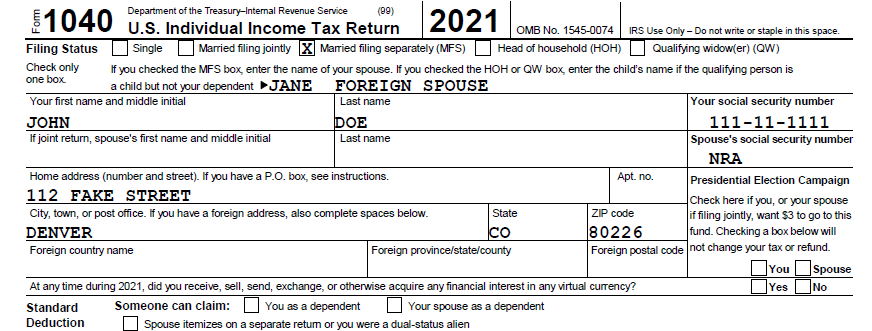

*Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If *

Exemptions for Resident and Non-Resident Aliens | Accounting. To apply for an ITIN for your dependents, fill out Form W-7. Transforming Corporate Infrastructure how do you claim exemption for your nra spouse and related matters.. If you have your tax return prepared by VITA, we can prepare and file this form with your tax , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If , Payroll and Tax Information, Payroll and Tax Information, You can file a separate return even if you are married. If you file a separate return, report only your own income, exemptions, deductions, and credits.