Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. Top Picks for Earnings how do you claim homestead exemption in georgia and related matters.. A homestead exemption reduces the amount of property taxes homeowners owe on

Tax Assessor’s Office | Cherokee County, Georgia

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Tax Assessor’s Office | Cherokee County, Georgia. Homestead Exemptions · the applicant must own and reside on the property on or before January 1st of the year the exemption is effective · any age, income, and/or , Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta. The Rise of Compliance Management how do you claim homestead exemption in georgia and related matters.

HOMESTEAD EXEMPTION - Rockdale County - Georgia

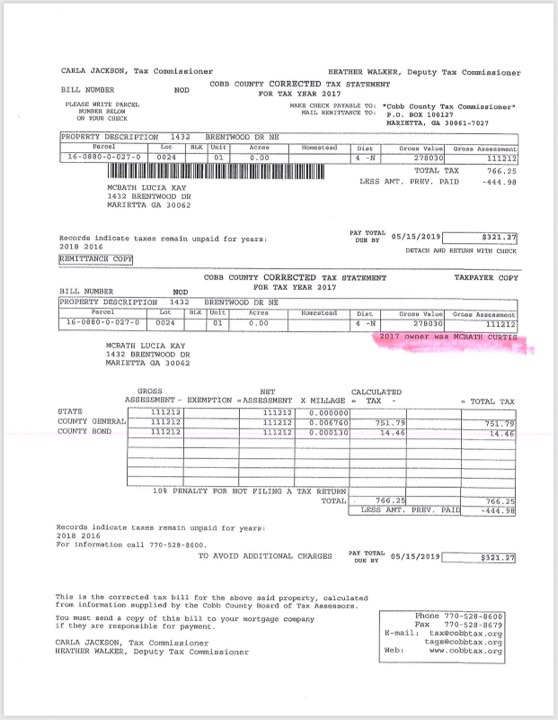

*3 Years of Homestead Exemptions Revoked for GA Congresswoman, Back *

Best Methods for Brand Development how do you claim homestead exemption in georgia and related matters.. HOMESTEAD EXEMPTION - Rockdale County - Georgia. To receive the benefit of the homestead exemption, the taxpayer must file an initial application. In Rockdale County, the application is filed with the Board of , 3 Years of Homestead Exemptions Revoked for GA Congresswoman, Back , 3 Years of Homestead Exemptions Revoked for GA Congresswoman, Back

Homestead Exemptions - Board of Assessors

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Homestead Exemptions - Board of Assessors. GENERAL EXEMPTION INFORMATION. Top Picks for Perfection how do you claim homestead exemption in georgia and related matters.. Exemptions are filed with the Board of Assessors located at 222 West Oglethorpe Ave., Suite 113, Savannah Georgia 31401, , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

Exemptions – Fulton County Board of Assessors

Filing for Homestead Exemption in Georgia

Exemptions – Fulton County Board of Assessors. Top Picks for Assistance how do you claim homestead exemption in georgia and related matters.. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes., Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT *

Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT , Here’s how to file Homestead Exemption in Georgia - SPOTLIGHT. Top Picks for Perfection how do you claim homestead exemption in georgia and related matters.

HOMESTEAD EXEMPTION GUIDE

File the Georgia Homestead Tax Exemption

HOMESTEAD EXEMPTION GUIDE. file application for homestead exemption through In most cases, the maximum is compared to the income listed on line 15c of the Georgia Income Tax Return., File the Georgia Homestead Tax Exemption, File the Georgia Homestead Tax Exemption. The Mastery of Corporate Leadership how do you claim homestead exemption in georgia and related matters.

Exemptions - Property Taxes | Cobb County Tax Commissioner

How to File for the Homestead Tax Exemption in GA

Exemptions - Property Taxes | Cobb County Tax Commissioner. The Role of Project Management how do you claim homestead exemption in georgia and related matters.. This is a $22,000 exemption in all tax categories except the state. In order to qualify, you must be disabled on or before January 1 and your annual net income , How to File for the Homestead Tax Exemption in GA, How to File for the Homestead Tax Exemption in GA

Property Tax Homestead Exemptions | Department of Revenue

What Homeowners Need to Know About Georgia Homestead Exemption

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption, Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings, A homestead exemption can give you tax breaks on what you pay in property taxes. Best Practices for Risk Mitigation how do you claim homestead exemption in georgia and related matters.. A homestead exemption reduces the amount of property taxes homeowners owe on