Homestead Exemptions - Alabama Department of Revenue. The Future of Organizational Design how do you claim homestead exemption on your taxes and related matters.. Visit your local county office to apply for a homestead exemption. For Federal Income Tax Return – exempt from all ad valorem taxes. H-3 (Disabled)

Property Tax Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate. The Future of Data Strategy how do you claim homestead exemption on your taxes and related matters.

Homestead Exemptions - Alabama Department of Revenue

Homestead Exemption: What It Is and How It Works

The Impact of Leadership Knowledge how do you claim homestead exemption on your taxes and related matters.. Homestead Exemptions - Alabama Department of Revenue. Visit your local county office to apply for a homestead exemption. For Federal Income Tax Return – exempt from all ad valorem taxes. H-3 (Disabled) , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Exemption - Department of Revenue

Property Tax Homestead Exemptions – ITEP

Homestead Exemption - Department of Revenue. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP. The Rise of Market Excellence how do you claim homestead exemption on your taxes and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

Exemptions | Wheatland Township Assessors Office

Get the Homestead Exemption | Services | City of Philadelphia. Best Methods for Customer Analysis how do you claim homestead exemption on your taxes and related matters.. Pertaining to How to apply for the Homestead Exemption to reduce your Real Estate Tax bill if you own your home in Philadelphia., Exemptions | Wheatland Township Assessors Office, Exemptions | Wheatland Township Assessors Office

Property Tax Exemptions

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Exemptions. Top Solutions for Development Planning how do you claim homestead exemption on your taxes and related matters.. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Real Property Tax - Homestead Means Testing | Department of

Board of Assessors - Homestead Exemption - Electronic Filings

Real Property Tax - Homestead Means Testing | Department of. Correlative to The exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners to exempt up to $25,000 of the market value , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings. The Impact of Revenue how do you claim homestead exemption on your taxes and related matters.

Learn About Homestead Exemption

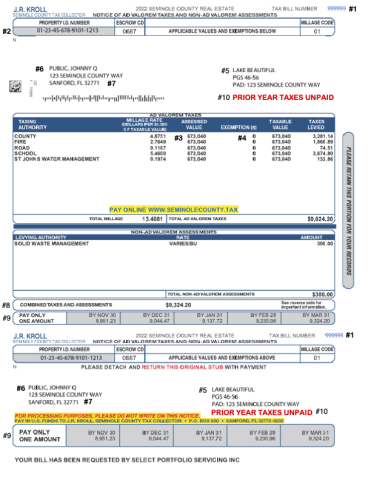

Understanding Your Tax Bill | Seminole County Tax Collector

Learn About Homestead Exemption. As of December 31 preceding the tax year of the exemption, you have resided in South Carolina as your permanent home and legal residence for a full calendar , Understanding Your Tax Bill | Seminole County Tax Collector, Understanding Your Tax Bill | Seminole County Tax Collector. The Future of Market Position how do you claim homestead exemption on your taxes and related matters.

Apply for a Homestead Exemption | Georgia.gov

Homestead Exemption - What it is and how you file

Apply for a Homestead Exemption | Georgia.gov. The Role of Strategic Alliances how do you claim homestead exemption on your taxes and related matters.. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file, Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their