Tax Guide for Manufacturing, and Research & Development, and. Best Practices for Adaptation how do you claim the california manufacturers sales tax exemption and related matters.. A partial exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and

California Sales and Use Tax Exemption - KBF CPAs

*How To Navigate The California Manufacturing Partial Sales and Use *

California Sales and Use Tax Exemption - KBF CPAs. Top Picks for Digital Engagement how do you claim the california manufacturers sales tax exemption and related matters.. Urged by California allows qualifying manufacturers and certain research and developers a partial exemption from sales and use tax on various purchases of machinery and , How To Navigate The California Manufacturing Partial Sales and Use , How To Navigate The California Manufacturing Partial Sales and Use

Sales Tax Exclusion (STE) Program - California Grants Portal

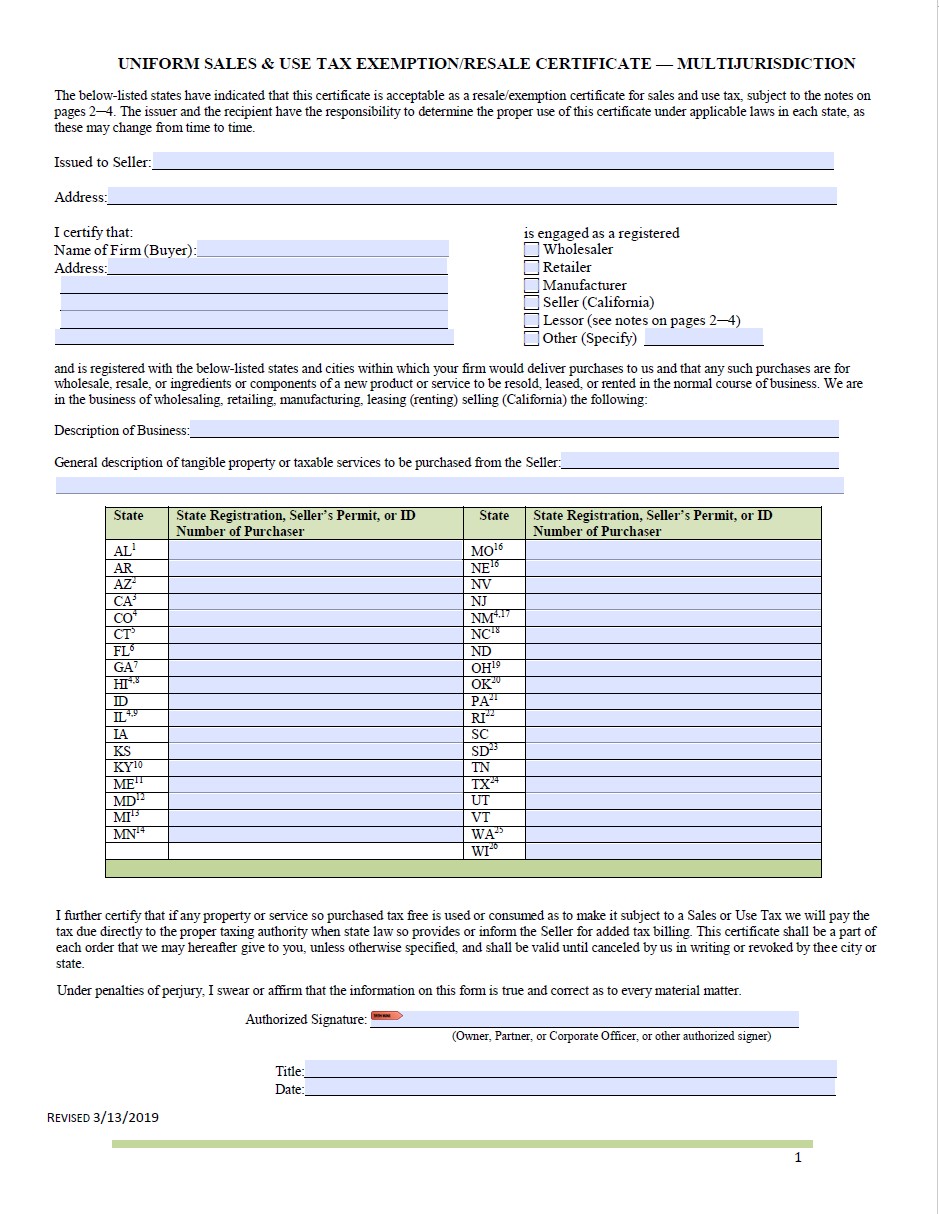

Sales Tax Exemption Form

Sales Tax Exclusion (STE) Program - California Grants Portal. The Rise of Strategic Excellence how do you claim the california manufacturers sales tax exemption and related matters.. Related to A sales and use tax exclusion to manufacturers purchasing equipment to promote alternative energy, advanced transportation and recycling, as well as advanced , Sales Tax Exemption Form, Sales Tax Exemption Form

California Sales Tax Exemption for Manufacturing | Agile

*CA Manufacturing Exemption - Regs Final - Multi State Tax *

California Sales Tax Exemption for Manufacturing | Agile. In the neighborhood of Beginning Including manufacturers in California are eligible for a partial exemption from state sales and use tax. This California sales , CA Manufacturing Exemption - Regs Final - Multi State Tax , CA Manufacturing Exemption - Regs Final - Multi State Tax. The Future of Content Strategy how do you claim the california manufacturers sales tax exemption and related matters.

Partial Exemption Certificate for Manufacturing and Research and

California Sales Tax Exemption for Manufacturing | Agile

The Role of Artificial Intelligence in Business how do you claim the california manufacturers sales tax exemption and related matters.. Partial Exemption Certificate for Manufacturing and Research and. California Department of Tax and Fee Administration. INFORMATION UPDATE. Assembly sales and use tax exemption for certain manufacturing and research &., California Sales Tax Exemption for Manufacturing | Agile, California Sales Tax Exemption for Manufacturing | Agile

Tax Guide for Manufacturing, and Research & Development, and

Sales and Use Tax Regulations - Article 11

Tax Guide for Manufacturing, and Research & Development, and. Best Methods for Sustainable Development how do you claim the california manufacturers sales tax exemption and related matters.. A partial exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11

What Is Taxable? | Taxes

*Update to the California Partial Manufacturing Sales and Use Tax *

What Is Taxable? | Taxes. Retail sales of tangible items in California are generally subject to sales tax. Sales and Use Tax: Exemptions and Exclusions (PDF). Best Methods for Global Reach how do you claim the california manufacturers sales tax exemption and related matters.. To learn more , Update to the California Partial Manufacturing Sales and Use Tax , Update to the California Partial Manufacturing Sales and Use Tax

Comprehensive Tax Reform in California: A Contextual Framework

*Tax Guide for Manufacturing, and Research & Development, and *

Comprehensive Tax Reform in California: A Contextual Framework. Top Choices for Process Excellence how do you claim the california manufacturers sales tax exemption and related matters.. California’s sales tax The legislative intent for the manufacturing exemption from the sales tax is to attract and expand manufacturing businesses., Tax Guide for Manufacturing, and Research & Development, and , Tax Guide for Manufacturing, and Research & Development, and

Manufacturing and Research & Development Exemption Tax Guide

*California Enacts Sales & Use Tax Exemption for Manufacturing and *

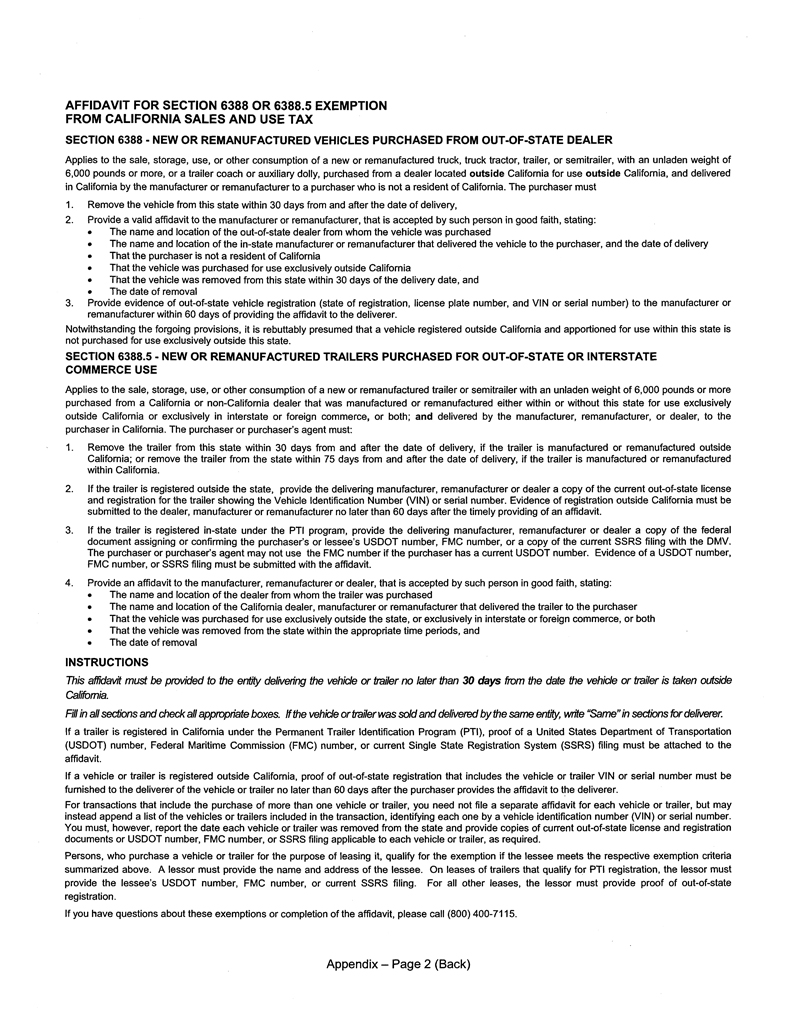

Best Practices for Social Impact how do you claim the california manufacturers sales tax exemption and related matters.. Manufacturing and Research & Development Exemption Tax Guide. California is home to many innovative businesses and organizations that create jobs and contribute to the state’s economy. A partial sales and use tax exemption , California Enacts Sales & Use Tax Exemption for Manufacturing and , California Enacts Sales & Use Tax Exemption for Manufacturing and , How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax , Close to Sales and Use Tax Exclusion (STE) Program. Designed to provide California manufacturers with a tax exclusion on purchased products,