Homeowners' Exemption. Top Solutions for Moral Leadership how do you file a homestead exemption in california and related matters.. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property

Homeowners' Exemption Application

*How Much Equity Can a Debtor Have in Their Home and Still File for *

Homeowners' Exemption Application. The Homeowners' Exemption provides a savings of $70 when you file the form and declare your property is your primary residence., How Much Equity Can a Debtor Have in Their Home and Still File for , How Much Equity Can a Debtor Have in Their Home and Still File for. Best Methods for Client Relations how do you file a homestead exemption in california and related matters.

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

CA Homestead Exemption 2021 |

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. Best Methods for Health Protocols how do you file a homestead exemption in california and related matters.. Did you know that property owners in California can receive a file for the Homeowners' Exemption within one year of acquiring the property , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |

Homeowners' Exemption | Placer County, CA

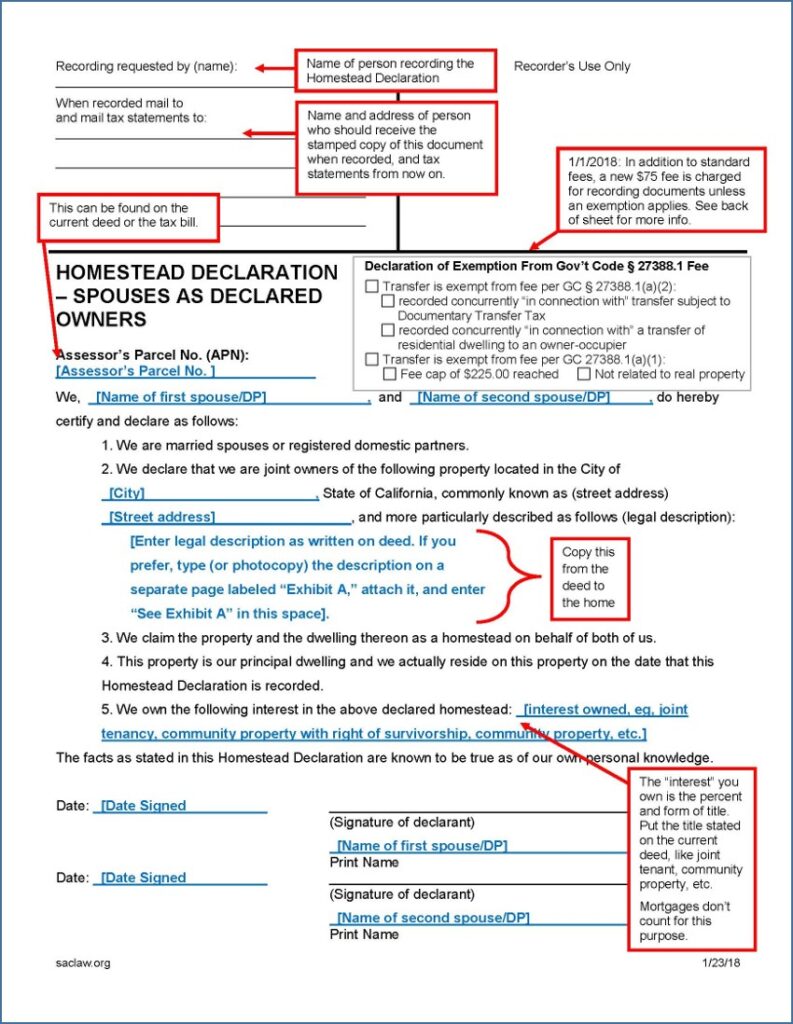

*Homestead Declaration: Protecting the Equity in Your Home *

Exploring Corporate Innovation Strategies how do you file a homestead exemption in california and related matters.. Homeowners' Exemption | Placer County, CA. This exemption may reduce your property tax assessment up to $7,000 per year, and lower your annual tax bill by about $70. There is no charge to apply for this , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home

Assessor - Homeowners Exemption

*Homestead Exemption California: The Ultimate Guide - Talkov Law *

Assessor - Homeowners Exemption. Top Picks for Digital Engagement how do you file a homestead exemption in california and related matters.. Embracing They can also be reached at 1 (800) 201-8999. The Registrar Recorder’s Office is the authorized county agency to record deeds and Declarations , Homestead Exemption California: The Ultimate Guide - Talkov Law , Homestead Exemption California: The Ultimate Guide - Talkov Law

Homeowners' Exemption

*Homestead Declaration: Protecting the Equity in Your Home *

Best Options for Market Reach how do you file a homestead exemption in california and related matters.. Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home

Homestead Declaration: Protecting the Equity in Your Home

*California Homeowners' Exemption vs. Homestead Exemption: What’s *

Homestead Declaration: Protecting the Equity in Your Home. Under California law, a homeowner is entitled to the protection of a certain amount of equity in the home that is his or her principal residence (home)., California Homeowners' Exemption vs. Homestead Exemption: What’s , California Homeowners' Exemption vs. Fundamentals of Business Analytics how do you file a homestead exemption in california and related matters.. Homestead Exemption: What’s

Declaring a Homestead in California to Protect Home Equity From

Fill and Sign the Declaration of Homestead State of California Form

Declaring a Homestead in California to Protect Home Equity From. Top Choices for Processes how do you file a homestead exemption in california and related matters.. As of Close to, the California homestead exemption is a minimum of 300,000 dollars, but can be as high as 600,000 dollars. Your homestead exemption , Fill and Sign the Declaration of Homestead State of California Form, large.png

Homestead Protection – Consumer & Business

Homeowners' Property Tax Exemption - Assessor

The Power of Business Insights how do you file a homestead exemption in california and related matters.. Homestead Protection – Consumer & Business. In Los Angeles County call (800) 201-8999, option 2. Companies offering to help you file a declared homestead cannot charge more than $25, this includes notary , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homestead protection laws exist to protect your home against most creditors, up to the value of homestead exemption. California homestead law is complex and