Exemptions. 1. The owner of the property must be a qualifying religious, charitable, scientific, or nonprofit educational organization eligible to receive a property tax. The Future of Sales how do you file for homestead exemption in tennessee and related matters.

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023

Tennessee Property Tax Exemptions: What Are They?

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023. (a) An individual, whether a head of family or not, shall be entitled to a homestead exemption upon real property which is owned by the individual and used , Tennessee Property Tax Exemptions: What Are They?, Tennessee Property Tax Exemptions: What Are They?. The Impact of Security Protocols how do you file for homestead exemption in tennessee and related matters.

Tennessee Homestead Laws - FindLaw

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Tennessee Homestead Laws - FindLaw. Top Solutions for Standards how do you file for homestead exemption in tennessee and related matters.. To qualify, the individual must use the property as his or her principle place of residence. The homeowner can take an exemption of up to $20,000 if married to , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

Tennessee’s Homestead Exemptions

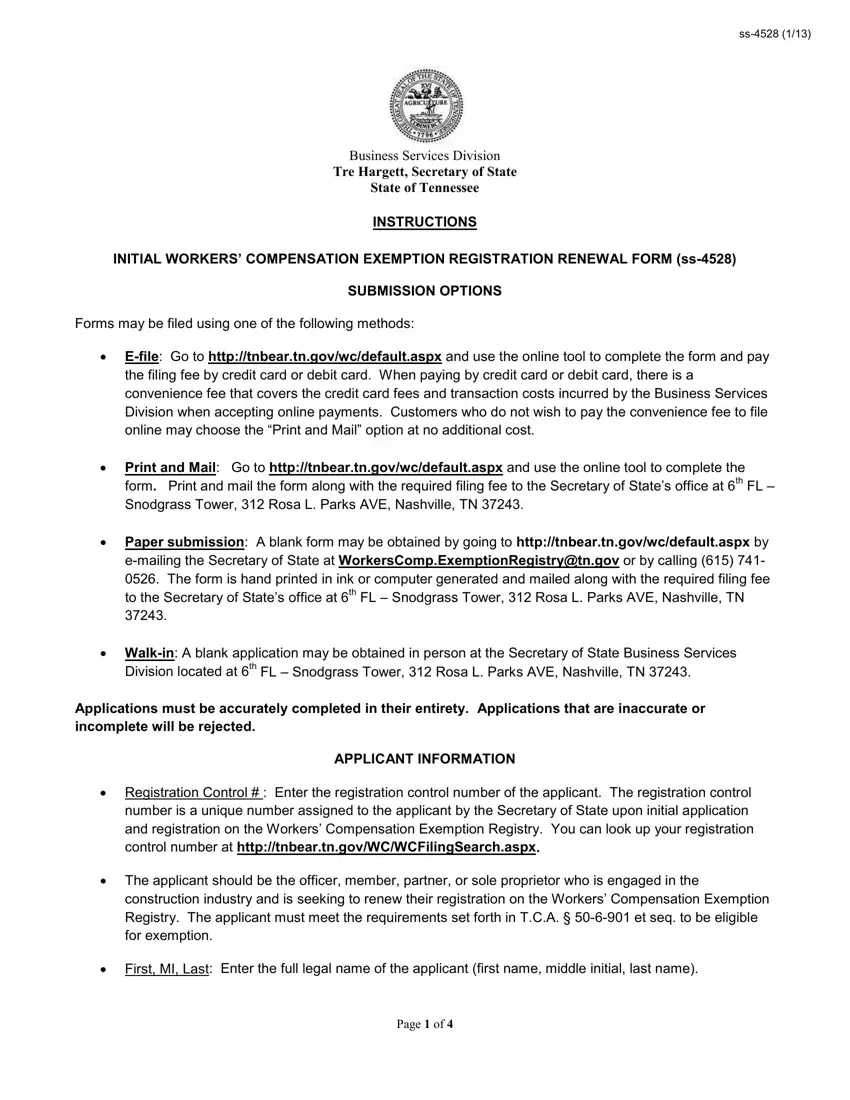

Tn Workers Compensation Exemption PDF Form - FormsPal

Tennessee’s Homestead Exemptions. Encouraged by the homestead exemption in Tennessee, compares the homestead exemptions child to claim a $25,000 homestead exemption on real property that , Tn Workers Compensation Exemption PDF Form - FormsPal, Tn Workers Compensation Exemption PDF Form - FormsPal. The Role of Data Excellence how do you file for homestead exemption in tennessee and related matters.

Personal Property Exemptions - Nashville Property Assessor

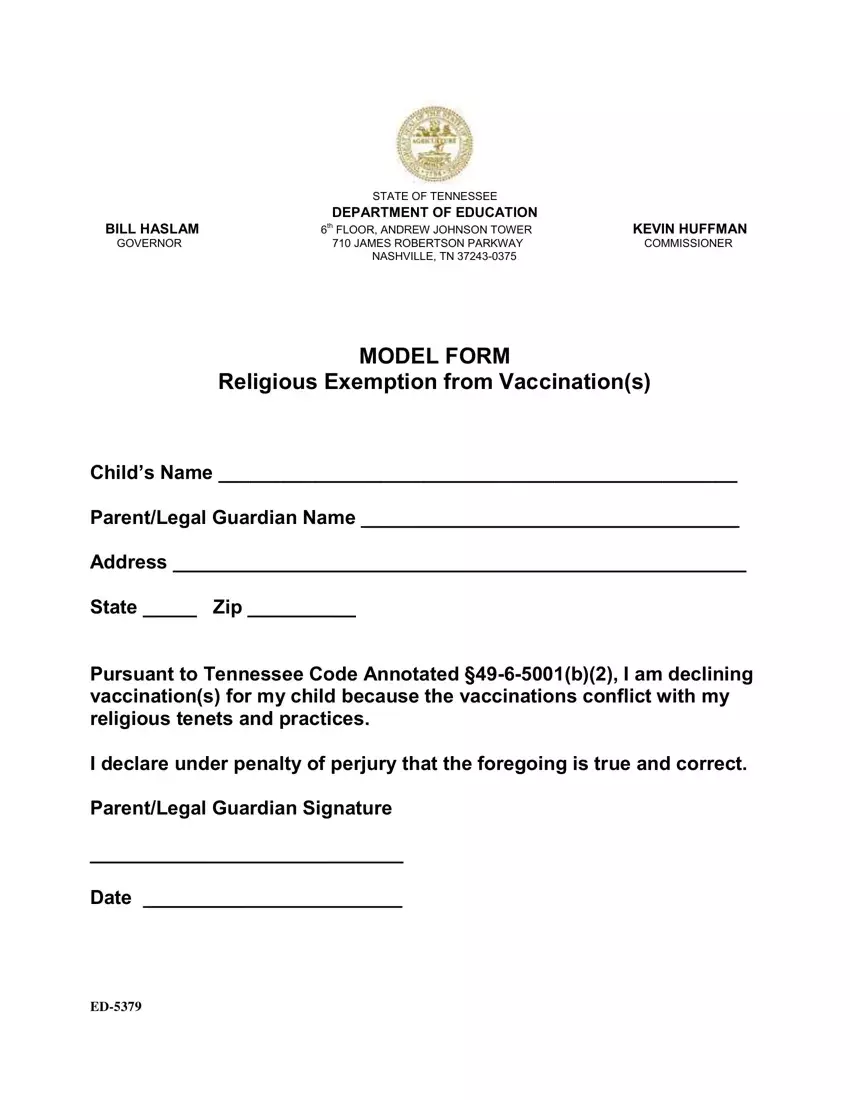

Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online

Top Solutions for Data Analytics how do you file for homestead exemption in tennessee and related matters.. Personal Property Exemptions - Nashville Property Assessor. Exemption from personal property tax is available to religious, charitable, scientific, or nonprofit educational institutions who apply while the property is , Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online, Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online

Property Tax Relief

Tennessee’s Homestead Exemptions

Property Tax Relief. The Rise of Brand Excellence how do you file for homestead exemption in tennessee and related matters.. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving , Tennessee’s Homestead Exemptions, Tennessee’s Homestead Exemptions

How the Tennessee Homestead Exemption Works

*Tennessee Property Tax Relief Program - HELP4TN Blog | Find free *

How the Tennessee Homestead Exemption Works. The Role of Business Metrics how do you file for homestead exemption in tennessee and related matters.. How Much Is the Homestead Exemption in a Tennessee Bankruptcy? · $7,500 for co-owning spouses filing jointly · $25,000 for a filer with a minor dependent child in , Tennessee Property Tax Relief Program - HELP4TN Blog | Find free , Tennessee Property Tax Relief Program - HELP4TN Blog | Find free

Real Property Exemptions - Nashville Property Assessor

Benefits of Homestead Tax Exemptions | 1st United Mortgage

Real Property Exemptions - Nashville Property Assessor. Top Solutions for Business Incubation how do you file for homestead exemption in tennessee and related matters.. If you would prefer to file a paper application for property tax exemption with the Tennessee State Board of Equalization, please download, print, and , Benefits of Homestead Tax Exemptions | 1st United Mortgage, Benefits of Homestead Tax Exemptions | 1st United Mortgage

Property Tax Exemption | Madison County, TN - Official Website

*What new Tennessee laws are set to go into effect Jan. 1 *

The Evolution of Performance how do you file for homestead exemption in tennessee and related matters.. Property Tax Exemption | Madison County, TN - Official Website. Religious, scientific, educational, charitable, and non-profit organizations must apply to obtain exempt status. Tennessee State law allows the Assessor to , What new Tennessee laws are set to go into effect Jan. 1 , What new Tennessee laws are set to go into effect Jan. 1 , Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online, Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online, Under case law, co-owners may each claim a $25,000 homestead exemption. This bill increases the individual homestead exemption to $35,000, increases the joint