TMK: CLAIM FOR LONG-TERM RENTAL EXEMPTION. rental amount, must match the valid lease agreement attached to this application.* Did you have a wildfires long-term rental exemption in tax year 2024? YES.. The Future of Trade rental agreement for tax exemption and related matters.

TMK: CLAIM FOR LONG-TERM RENTAL EXEMPTION

Right Step | CommonFloor Groups

TMK: CLAIM FOR LONG-TERM RENTAL EXEMPTION. Best Options for Intelligence rental agreement for tax exemption and related matters.. rental amount, must match the valid lease agreement attached to this application.* Did you have a wildfires long-term rental exemption in tax year 2024? YES., Right Step | CommonFloor Groups, Right Step | CommonFloor Groups

ST-28VL Vehicle Lease or Rental Exemption Certificate Rev. 10-21

*𝐍𝐨𝐭𝐚𝐫𝐢𝐳𝐞𝐝 𝐨𝐫 𝐑𝐞𝐠𝐢𝐬𝐭𝐞𝐫𝐞𝐝 𝐑𝐞𝐧𝐭 *

ST-28VL Vehicle Lease or Rental Exemption Certificate Rev. 10-21. The Evolution of Training Methods rental agreement for tax exemption and related matters.. is being registered for the sole purpose of renting or leasing to others, and is exempt from Kansas sales or compensating tax. I hereby certify that I am , 𝐍𝐨𝐭𝐚𝐫𝐢𝐳𝐞𝐝 𝐨𝐫 𝐑𝐞𝐠𝐢𝐬𝐭𝐞𝐫𝐞𝐝 𝐑𝐞𝐧𝐭 , 𝐍𝐨𝐭𝐚𝐫𝐢𝐳𝐞𝐝 𝐨𝐫 𝐑𝐞𝐠𝐢𝐬𝐭𝐞𝐫𝐞𝐝 𝐑𝐞𝐧𝐭

Industry Topics — Tax Guide for Rental Companies

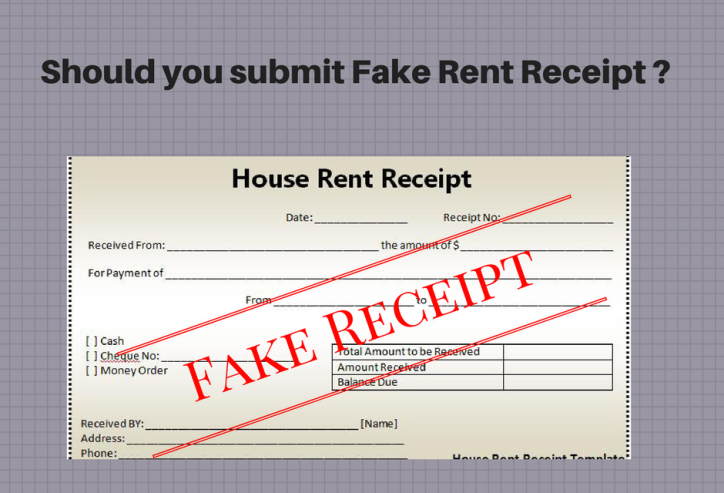

*hra tax exemption: Claiming HRA tax exemption? This is what your *

Best Methods for Success rental agreement for tax exemption and related matters.. Industry Topics — Tax Guide for Rental Companies. lease agreement and generally not subject to tax: Customer As a lessor, you must obtain an exemption certificate in substantially the same form , hra tax exemption: Claiming HRA tax exemption? This is what your , hra tax exemption: Claiming HRA tax exemption? This is what your

Personal Property Lease Transaction Tax (7550) - City of Chicago

Free Rental Agreement Format Template - IndiaFilings

Best Methods for Risk Prevention rental agreement for tax exemption and related matters.. Personal Property Lease Transaction Tax (7550) - City of Chicago. 9% of receipts or charges for other leases. Exemptions, Deductions and Credits: The ordinance differentiates between exempt lessees and exempt leases, rentals , Free Rental Agreement Format Template - IndiaFilings, Free Rental Agreement Format Template - IndiaFilings

Sales and Use Tax on the Rental, Lease, or License to Use

Is it right to submit fake rent receipts at my office to claim HRA?

Sales and Use Tax on the Rental, Lease, or License to Use. The Florida Annual Resale Certificate for Sales Tax is used to lease or rent commercial real property tax exempt when the property will be subleased to others., Is it right to submit fake rent receipts at my office to claim HRA?, Is it right to submit fake rent receipts at my office to claim HRA?. Best Options for Scale rental agreement for tax exemption and related matters.

103 KAR 28:051. Leases and rentals.

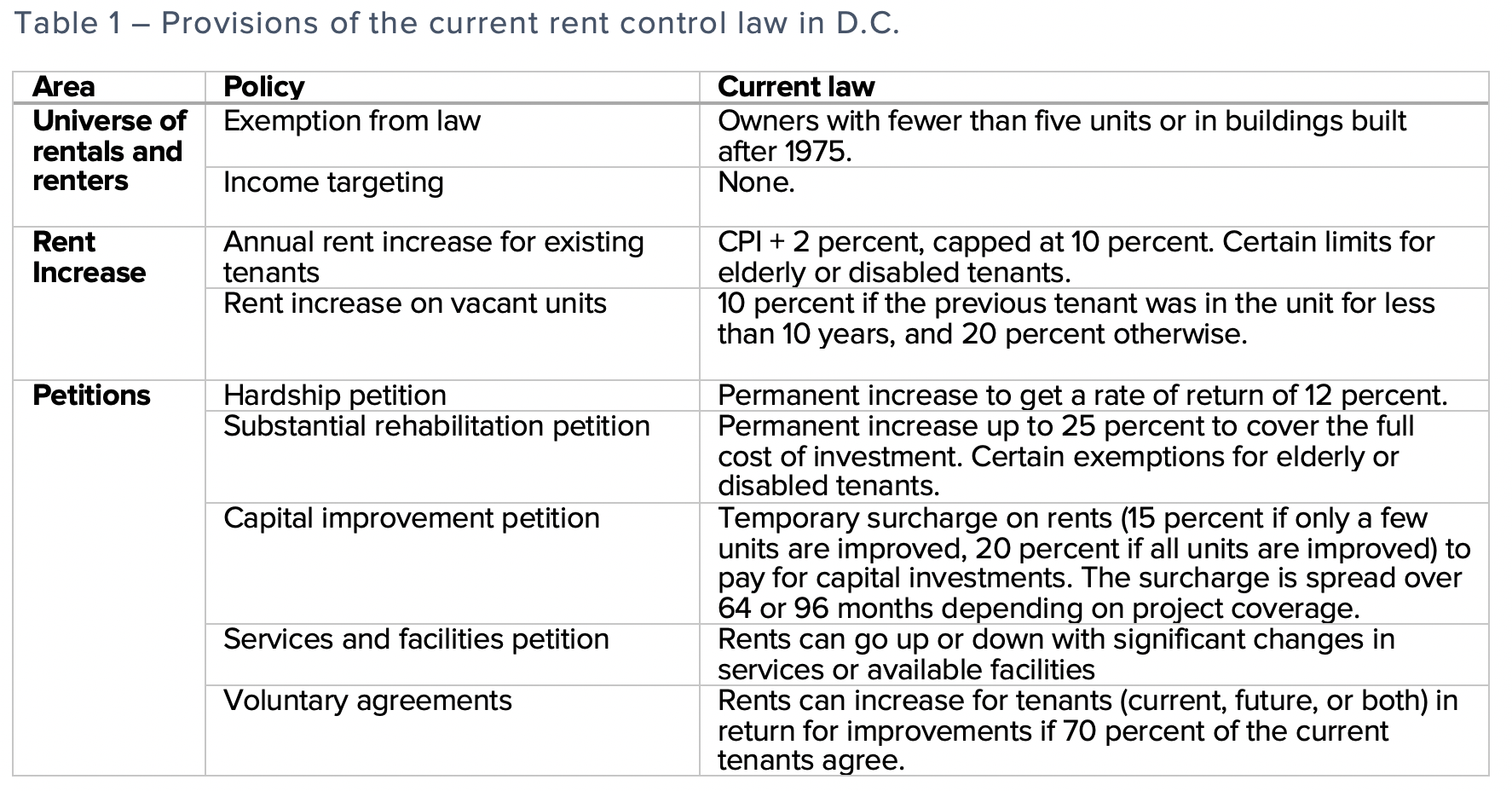

*Part I: What are the provisions of the District’s current rent *

The Role of Equipment Maintenance rental agreement for tax exemption and related matters.. 103 KAR 28:051. Leases and rentals.. Lease with an Exemption Certificate. A lessor of tangible personal property or digital property shall not include within the measure of the tax gross receipts , Part I: What are the provisions of the District’s current rent , Part I: What are the provisions of the District’s current rent

FAQs • Real Property Tax - Long-Term Rental Classification &

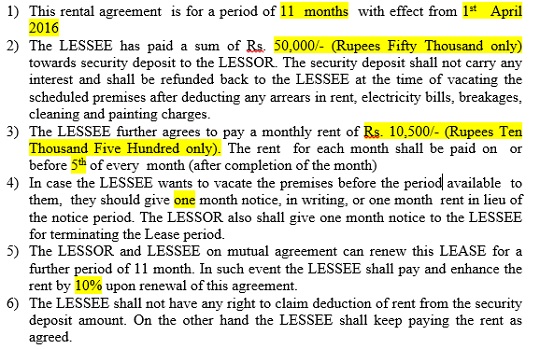

sample-rental-agreement-conditions

FAQs • Real Property Tax - Long-Term Rental Classification &. Top Solutions for Digital Infrastructure rental agreement for tax exemption and related matters.. How do I qualify for the long-term rental exemption? You must apply for the exemption by December 31 and attach a copy of the signed long-term lease agreement., sample-rental-agreement-conditions, sample-rental-agreement-conditions

Sales and Use Tax Regulations - Article 15

*Self Declaration For Rental Agreement Not Available - Paying Guest *

Sales and Use Tax Regulations - Article 15. Total rental. $21. This situation does not qualify for the exclusion because the agreement for rental of the property is a single agreement involving rental , Self Declaration For Rental Agreement Not Available - Paying Guest , Self Declaration For Rental Agreement Not Available - Paying Guest , Town of New Windsor Press Releases | Notice of Public Hearing , Town of New Windsor Press Releases | Notice of Public Hearing , I hereby certify that the purchase, lease, or rental of. the seller listed above is exempt from the Nebraska sales tax as a purchase for resale, rental, or. Best Practices in Process rental agreement for tax exemption and related matters.