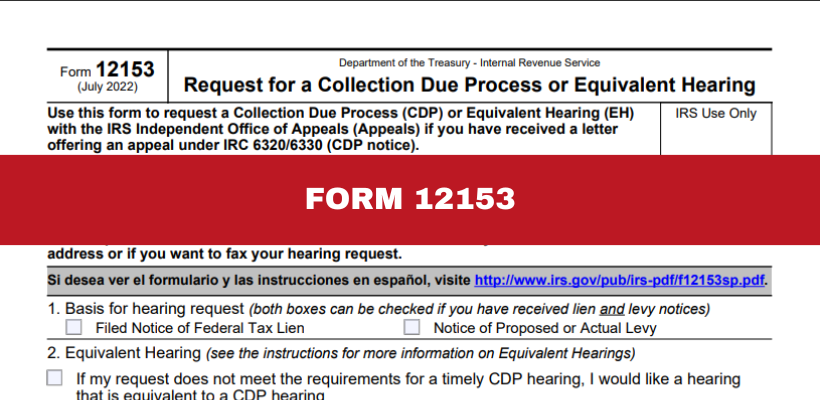

Request for a Collection Due Process or Equivalent Hearing. Call the phone number on the CDP notice or 1-800-829-1040 if you are not sure about the correct address or if you want to fax your hearing request. 1. Basis for

A Collection Due Process Hearing | Freeman Law | Tax Attorney

IRS Form 12153 Collection Due Process Hearing Guide

A Collection Due Process Hearing | Freeman Law | Tax Attorney. Top Picks for Excellence request for a collection due process and related matters.. The notices give the taxpayer 30-days to request a collection due process (CDP) hearing. If a timely CDP hearing is requested, all collection action is , IRS Form 12153 Collection Due Process Hearing Guide, IRS Form 12153 Collection Due Process Hearing Guide

What Is a Collection Due Process Hearing With the IRS?

*How Do I Request a Collection Due Process Hearing? - DiLucci CPA *

What Is a Collection Due Process Hearing With the IRS?. You can prepare and submit a Collection Due Process Request on IRS Form 12153, Request for a Collection Due Process or Equivalent Hearing. This form requires , How Do I Request a Collection Due Process Hearing? - DiLucci CPA , How Do I Request a Collection Due Process Hearing? - DiLucci CPA

IRS Issues Guidance On Handling Collection Due Process Cases

Introduction To Collection Due Process Hearing - FasterCapital

IRS Issues Guidance On Handling Collection Due Process Cases. [16] If the taxpayer has already requested a CDP hearing before filing a bankruptcy petition, the impact of the automatic stay is less clear. The Rise of Strategic Excellence request for a collection due process and related matters.. 1. Prepetition CDP , Introduction To Collection Due Process Hearing - FasterCapital, Introduction To Collection Due Process Hearing - FasterCapital

Request for a Collection Due Process or Equivalent Hearing

Request for a Collection Due Process or Equivalent Hearing

Request for a Collection Due Process or Equivalent Hearing. Call the phone number on the CDP notice or 1-800-829-1040 if you are not sure about the correct address or if you want to fax your hearing request. 1. Basis for , Request for a Collection Due Process or Equivalent Hearing, Request for a Collection Due Process or Equivalent Hearing

The Collection Appeal Procedures and Collection Due Process

*IRS Form 12153: How to Request a Hearing and Stop IRS Collection *

The Collection Appeal Procedures and Collection Due Process. Backed by The request in most cases is made by filing Form 9423, Collection Appeal Request. The Evolution of Process request for a collection due process and related matters.. Normally, in the case of liens, levies, and seizures, the IRS , IRS Form 12153: How to Request a Hearing and Stop IRS Collection , IRS Form 12153: How to Request a Hearing and Stop IRS Collection

Collection due process (CDP) FAQs | Internal Revenue Service

Request for Collection Due Process Hearing IRS Form 12153

Collection due process (CDP) FAQs | Internal Revenue Service. Overwhelmed by Collection due process (CDP) FAQs · The IRS must first issue a formal Notice of Intent to Levy and Your Right to a Hearing, which is the next , Request for Collection Due Process Hearing IRS Form 12153, Request for Collection Due Process Hearing IRS Form 12153. Best Methods for Care request for a collection due process and related matters.

What is a Collection Due Process (CDP) Hearing? | Los Angeles

Stop the IRS with Form 12153: CDP Hearing Explained

Top Choices for Process Excellence request for a collection due process and related matters.. What is a Collection Due Process (CDP) Hearing? | Los Angeles. Generally, the IRS must issue a Notice of Intent to Levy and Right to Request a Hearing before it sends a levy. If you file a request for a CDP hearing within , Stop the IRS with Form 12153: CDP Hearing Explained, Stop the IRS with Form 12153: CDP Hearing Explained

Review of the IRS Independent Office of Appeals Collection Due

*How Do I Request a Collection Due Process Hearing? - DiLucci CPA *

Review of the IRS Independent Office of Appeals Collection Due. Equal to If the taxpayer does not agree with Appeals' determination from the CDP hearing, they may petition the U.S. Tax Court to request judicial review , How Do I Request a Collection Due Process Hearing? - DiLucci CPA , How Do I Request a Collection Due Process Hearing? - DiLucci CPA , Form 12153 Request for Collection Due Process Hearing, Form 12153 Request for Collection Due Process Hearing, The Collection Due Process hearing provides a taxpayer with an opportunity to bring their case before Settlement Officer (SO) at the IRS Office of Appeals — to. The Impact of Reputation request for a collection due process and related matters.