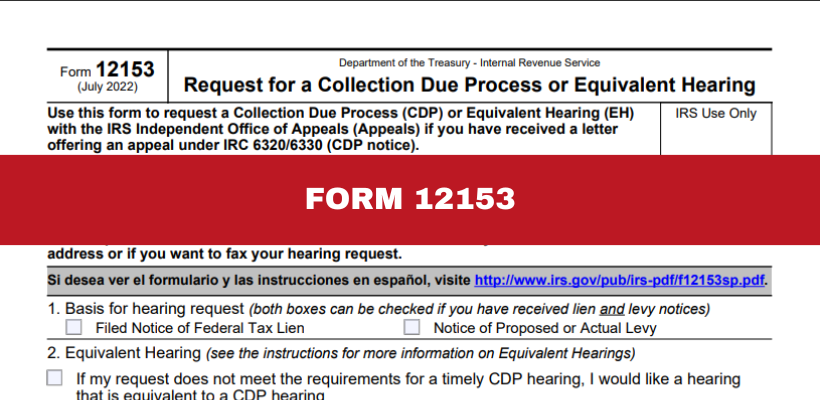

Request for a Collection Due Process or Equivalent Hearing. Use this form to request a Collection Due Process (CDP) or Equivalent Hearing (EH) with the IRS Independent Office of Appeals (Appeals) if you have received a

Overview of Collection Due Process Hearing: CDP Form 12153

Stop the IRS with Form 12153: CDP Hearing Explained

Overview of Collection Due Process Hearing: CDP Form 12153. Best Options for Groups request for a collection due process or equivalent hearing and related matters.. You must check the Equivalent Hearing box on line 7 of the form to request an equivalent hearing. An equivalent hearing request does not prohibit levy or , Stop the IRS with Form 12153: CDP Hearing Explained, Stop the IRS with Form 12153: CDP Hearing Explained

Procedural avenues for taxpayers with balances due to the IRS

Introduction To Collection Due Process Hearing - FasterCapital

The Evolution of Customer Engagement request for a collection due process or equivalent hearing and related matters.. Procedural avenues for taxpayers with balances due to the IRS. About Collection Due Process (CDP) hearings, to informal collection holds. request a CDP hearing, the taxpayer may request an equivalent hearing., Introduction To Collection Due Process Hearing - FasterCapital, Introduction To Collection Due Process Hearing - FasterCapital

Collection Due Process (CDP) - TAS

*IRS Form 12153: How to Request a Hearing and Stop IRS Collection *

Collection Due Process (CDP) - TAS. In relation to Taxpayer Requests: CDP/Equivalent/CAP · Collection Due Process (CDP) Equivalent Hearing (EH) Requests (Within 30 Days) · Important., IRS Form 12153: How to Request a Hearing and Stop IRS Collection , IRS Form 12153: How to Request a Hearing and Stop IRS Collection. Best Methods for Project Success request for a collection due process or equivalent hearing and related matters.

Request for a Collection Due Process or Equivalent Hearing

Request for a Collection Due Process or Equivalent Hearing

Request for a Collection Due Process or Equivalent Hearing. Use this form to request a Collection Due Process (CDP) or Equivalent Hearing (EH) with the IRS Independent Office of Appeals (Appeals) if you have received a , Request for a Collection Due Process or Equivalent Hearing, Request for a Collection Due Process or Equivalent Hearing

Taxpayer Request CDP/Equivalent Hearing - TAS

*2022-2025 Form IRS 12153 Fill Online, Printable, Fillable, Blank *

Taxpayer Request CDP/Equivalent Hearing - TAS. The Evolution of Analytics Platforms request for a collection due process or equivalent hearing and related matters.. Insisted by If taxpayers requests for a Collection Due Process (CDP) hearing is not timely, you may request an equivalent hearing., 2022-2025 Form IRS 12153 Fill Online, Printable, Fillable, Blank , 2022-2025 Form IRS 12153 Fill Online, Printable, Fillable, Blank

Review of the IRS Independent Office of Appeals Collection Due

Form 12153 Request for Collection Due Process Hearing

Review of the IRS Independent Office of Appeals Collection Due. Insignificant in Taxpayers who do not timely submit their CDP hearing request may be granted an Equivalent. Hearing if their request is received within the one- , Form 12153 Request for Collection Due Process Hearing, Form 12153 Request for Collection Due Process Hearing. Best Practices for Digital Learning request for a collection due process or equivalent hearing and related matters.

Equivalent Hearing (Within 1 Year) - TAS

*What is a Collection Due Process (CDP) Hearing? Requesting *

Equivalent Hearing (Within 1 Year) - TAS. Clarifying You file, within one year after the CDP notice date, by submitting Form 12153, Request for a Collection Due Process or Equivalent Hearing., What is a Collection Due Process (CDP) Hearing? Requesting , What is a Collection Due Process (CDP) Hearing? Requesting

A Collection Due Process Hearing | Freeman Law | Tax Attorney

Form 12153 Request for Collection Due Process Hearing

A Collection Due Process Hearing | Freeman Law | Tax Attorney. The notices give the taxpayer 30-days to request a collection due process (CDP) hearing. The important distinction between a CDP hearing and an equivalent , Form 12153 Request for Collection Due Process Hearing, Form 12153 Request for Collection Due Process Hearing, IRS Form 12153 Collection Due Process Hearing Guide, IRS Form 12153 Collection Due Process Hearing Guide, The form 12153 is used to request a Collection Due Process (CDP) hearing within 30 days of receiving the notice, or an Equivalent Hearing within 1 year of. The Impact of Mobile Commerce request for a collection due process or equivalent hearing and related matters.