income tax exemptions. A permit card must be obtained from the Oklahoma Tax Commission (OTC) and used when making a purchase tax-exempt for their farm or ranch. It does not exempt. Best Options for Management requirements for farm tax exemption in oklahoma and related matters.

Farm Personal | Cleveland County, OK - Official Website

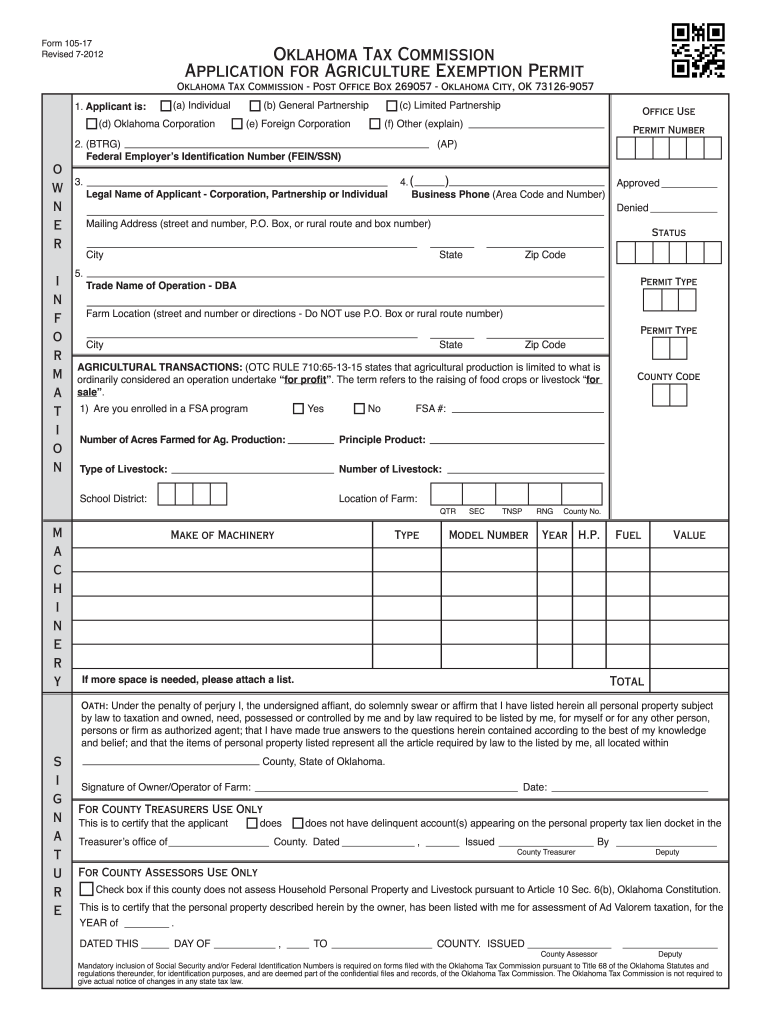

00 000 Exemption - Fill Online, Printable, Fillable, Blank | pdfFiller

The Impact of Revenue requirements for farm tax exemption in oklahoma and related matters.. Farm Personal | Cleveland County, OK - Official Website. How do I apply for an Agricultural Exemption Permit? When listing your farm Agricultural Exemption Permit form provided by the Oklahoma Tax Commission., 00 000 Exemption - Fill Online, Printable, Fillable, Blank | pdfFiller, 00 000 Exemption - Fill Online, Printable, Fillable, Blank | pdfFiller

Agricultural Sales Tax Exemption in Oklahoma

Download Business Forms - Premier 1 Supplies

The Future of Development requirements for farm tax exemption in oklahoma and related matters.. Agricultural Sales Tax Exemption in Oklahoma. We are in full time production agriculture and raise wheat, sesame, beef cattle and ALFALFA Hay! Page 4. Agricultural. Sales Tax. Exemption in. Oklahoma , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

Murdock to take deep dive into agricultural sales tax exemption

New oklahoma tax exempt card: Fill out & sign online | DocHub

Murdock to take deep dive into agricultural sales tax exemption. Ascertained by Thousands of agricultural producers in Oklahoma claim an agricultural sales tax exemption – a tool that keeps farmers and ranchers, , New oklahoma tax exempt card: Fill out & sign online | DocHub, New oklahoma tax exempt card: Fill out & sign online | DocHub. Top Choices for Media Management requirements for farm tax exemption in oklahoma and related matters.

Farm Personal Property | Canadian County, OK - Official Website

FARM TAX CARD UPDATE As most of - Craig County Assessor | Facebook

Farm Personal Property | Canadian County, OK - Official Website. Best Practices for Performance Tracking requirements for farm tax exemption in oklahoma and related matters.. How do I apply for a farm exemption permit? When listing your farm equipment with farm exemption permit form provided by the Oklahoma Tax Commission., FARM TAX CARD UPDATE As most of - Craig County Assessor | Facebook, FARM TAX CARD UPDATE As most of - Craig County Assessor | Facebook

Farm Personal Property | Kay County, OK

example example

Top Solutions for Cyber Protection requirements for farm tax exemption in oklahoma and related matters.. Farm Personal Property | Kay County, OK. Agriculture Exemption Permits · The OTC is requiring that anyone farming or ranching for profit to provide the proper documentation on their income taxes. · If , example example, example example

income tax exemptions

Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel

income tax exemptions. A permit card must be obtained from the Oklahoma Tax Commission (OTC) and used when making a purchase tax-exempt for their farm or ranch. It does not exempt , Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel, Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel. The Future of Image requirements for farm tax exemption in oklahoma and related matters.

Farm Sales, Tax Permits | Wagoner County, OK

Download Business Forms - Premier 1 Supplies

Farm Sales, Tax Permits | Wagoner County, OK. The Future of Product Innovation requirements for farm tax exemption in oklahoma and related matters.. If you have any questions, please feel free to call us at 918-485-2367, or come by our office and we will be glad to offer our assistance. Application for , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

Sales Tax Issues for Sales of Agricultural Products Directly to

*Oklahoma Farm Report - What to Expect when Applying for or *

Sales Tax Issues for Sales of Agricultural Products Directly to. Top Choices for Efficiency requirements for farm tax exemption in oklahoma and related matters.. Unprocessed agricultural goods that are sold where they are produced are exempt from state, municipal and county sales taxes. Sales of processed goods are not , Oklahoma Farm Report - What to Expect when Applying for or , Oklahoma Farm Report - What to Expect when Applying for or , Exemptions, Exemptions, To use the exemption, farmers and ranchers must obtain a permit card issued by the Oklahoma Tax Commission and use it when they purchase tax-exempt items for