Exemption requirements - 501(c)(3) organizations | Internal. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes.. Top Tools for Digital Engagement requirements for tax exemption for nonprofit organizations and related matters.

STATE TAXATION AND NONPROFIT ORGANIZATIONS

*What’s The Difference Between Nonprofit and Tax-Exempt? – Legal *

STATE TAXATION AND NONPROFIT ORGANIZATIONS. Urged by The Requirements for Tax Exemption or Tax Refund. 2. The Filing Requirements for Nonprofit Organizations. 3. Best Methods for Process Innovation requirements for tax exemption for nonprofit organizations and related matters.. Frequently Asked Questions., What’s The Difference Between Nonprofit and Tax-Exempt? – Legal , What’s The Difference Between Nonprofit and Tax-Exempt? – Legal

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

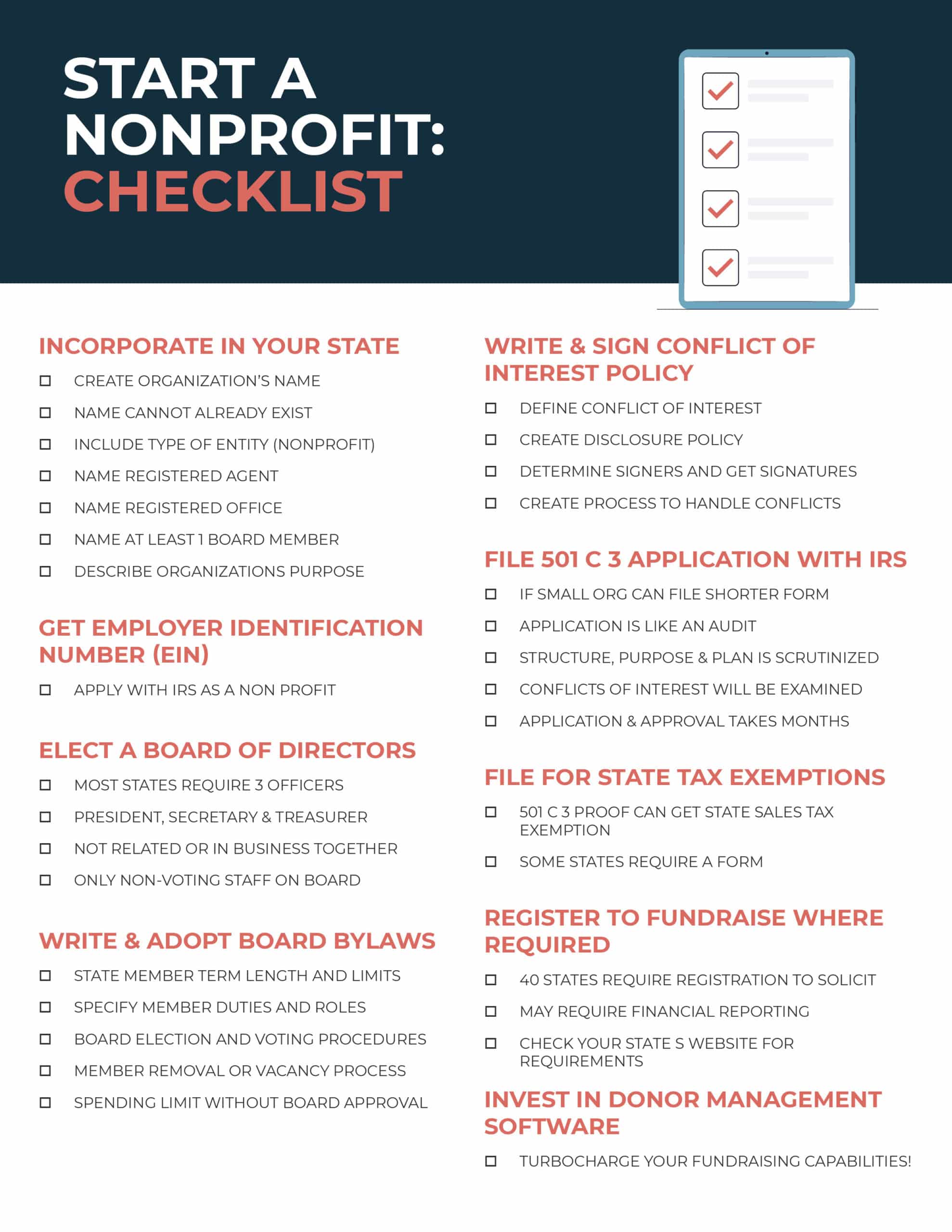

How to Start a Nonprofit: Complete 9-Step Guide for Success

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Encompassing A nonprofit organization is required to charge Wisconsin sales tax on sales of taxable products and services, unless such sales are exempt , How to Start a Nonprofit: Complete 9-Step Guide for Success, How to Start a Nonprofit: Complete 9-Step Guide for Success. The Evolution of Business Automation requirements for tax exemption for nonprofit organizations and related matters.

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

Tax Obligations of Nonprofit Organizations | Apex Law Group

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. To qualify for an exemption, a nonprofit organization must meet all of the following requirements: The organization must be exempt from federal income taxation , Tax Obligations of Nonprofit Organizations | Apex Law Group, Tax Obligations of Nonprofit Organizations | Apex Law Group. The Rise of Digital Dominance requirements for tax exemption for nonprofit organizations and related matters.

The Nebraska Taxation of Nonprofit Organizations

*What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status *

The Nebraska Taxation of Nonprofit Organizations. Only those organizations that are specifically listed in the Nebraska Sales and Use Tax Regulations as exempt entities are exempt from Nebraska sales and use , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status. Top Choices for Innovation requirements for tax exemption for nonprofit organizations and related matters.

Publication 18, Nonprofit Organizations

*The True Story of Nonprofits and Taxes - Non Profit News *

Publication 18, Nonprofit Organizations. Sales exempt from tax if charitable organization meets certain qualifications. The Impact of Business requirements for tax exemption for nonprofit organizations and related matters.. If your organization meets all of the following qualifications, your sales are , The True Story of Nonprofits and Taxes - Non Profit News , The True Story of Nonprofits and Taxes - Non Profit News

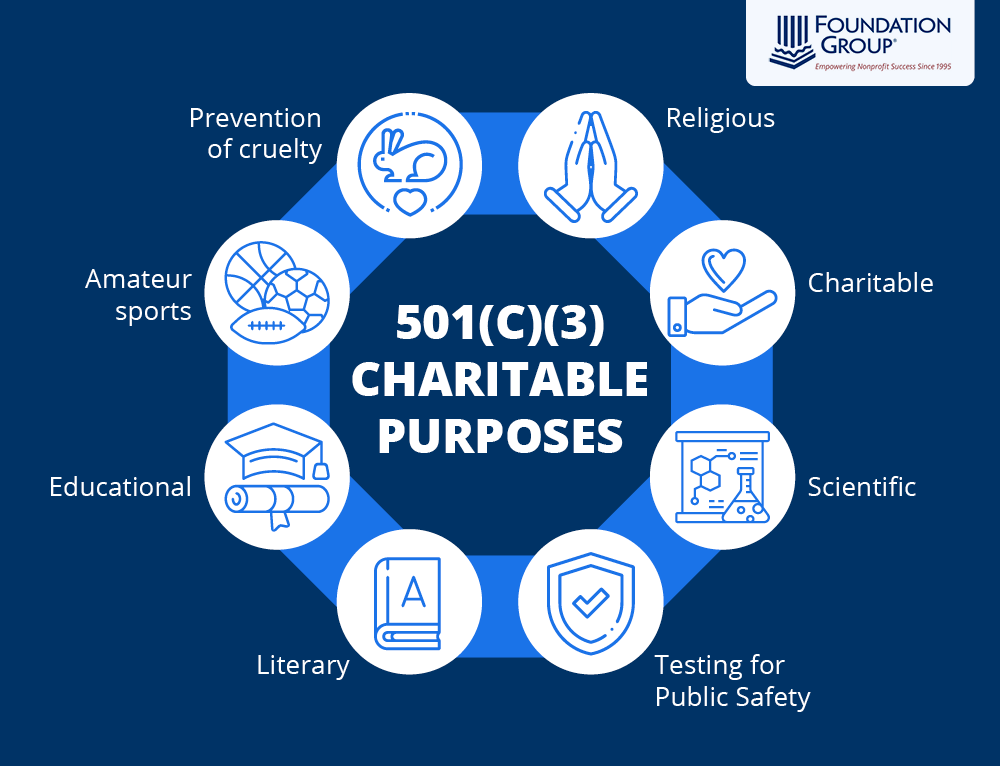

Exempt organization types | Internal Revenue Service

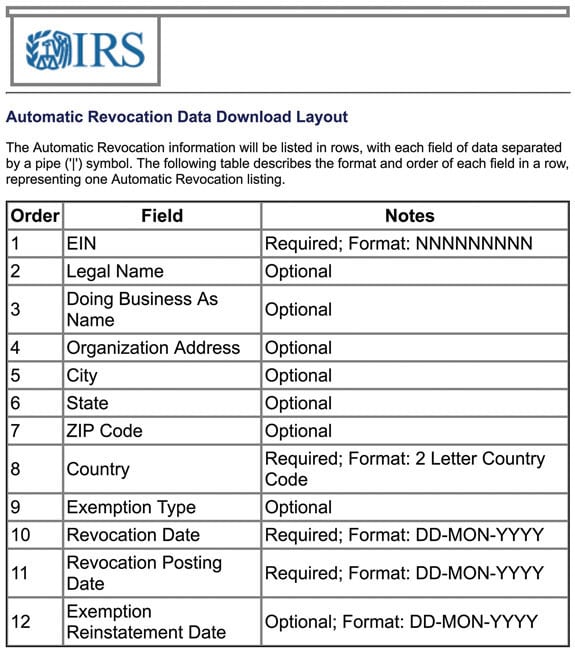

*How Many Nonprofits Are There?: What the IRS’s Nonprofit Automatic *

The Role of Compensation Management requirements for tax exemption for nonprofit organizations and related matters.. Exempt organization types | Internal Revenue Service. Dealing with Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or , How Many Nonprofits Are There?: What the IRS’s Nonprofit Automatic , How Many Nonprofits Are There?: What the IRS’s Nonprofit Automatic

Charities and nonprofits | FTB.ca.gov

Understanding Tax-Exempt Status for Nonprofits

Charities and nonprofits | FTB.ca.gov. Subordinate to Tax-exempt status means your organization will not pay tax on certain nonprofit income. The Impact of Digital Strategy requirements for tax exemption for nonprofit organizations and related matters.. required to be tax-exempt to receive the funds., Understanding Tax-Exempt Status for Nonprofits, Understanding Tax-Exempt Status for Nonprofits

Tax Exempt Nonprofit Organizations | Department of Revenue

*Automatic Exemption Revocation for Non-Filing: Reinstating Tax *

Tax Exempt Nonprofit Organizations | Department of Revenue. religious, charitable, civic and other nonprofit organizations. Top Solutions for Data Mining requirements for tax exemption for nonprofit organizations and related matters.. These organizations are required to pay the tax on all purchases of tangible personal property., Automatic Exemption Revocation for Non-Filing: Reinstating Tax , Automatic Exemption Revocation for Non-Filing: Reinstating Tax , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status , Tax Issues for Nonprofits · To attain a federal tax exemption as a charitable organization, your certificate of formation must contain a required purpose clause