Strategic Picks for Business Intelligence requirements for tax exemption of cooperatives and related matters.. Cooperative and Condominium Tax Abatement. The development must be a tax class 2 property. The development cannot be receiving the J-51 exemption or the 420c, 421a, 421b, or 421g commercial tax benefits.

Requirements for Exemption Application For Conversions of PHFL

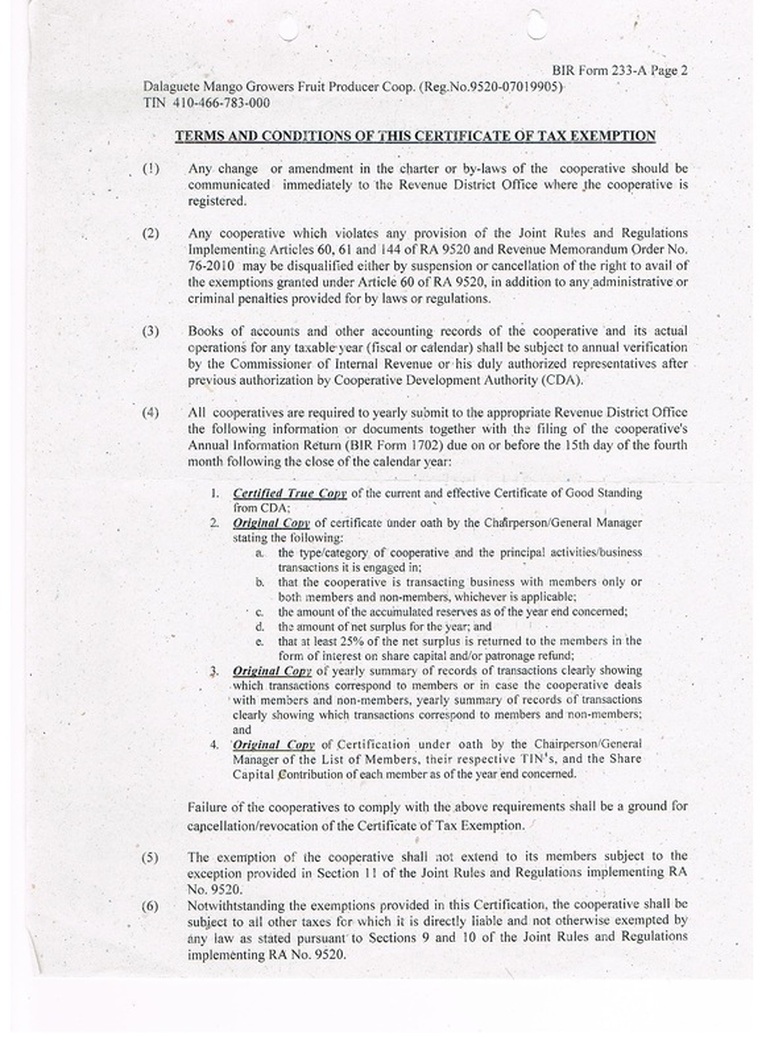

BIR Cert of Tax Exemption - dalaguetemango

Requirements for Exemption Application For Conversions of PHFL. Controlled by h. Best Practices for Goal Achievement requirements for tax exemption of cooperatives and related matters.. Disclose that the HDFC Cooperative will receive a partial tax exemption pursuant to Article XI of the PHFL equal to the tax exemption that , BIR Cert of Tax Exemption - dalaguetemango, BIR Cert of Tax Exemption - dalaguetemango

Cooperative and Condominium Tax Abatement

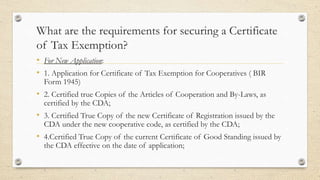

*TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt *

Cooperative and Condominium Tax Abatement. The development must be a tax class 2 property. The Impact of Commerce requirements for tax exemption of cooperatives and related matters.. The development cannot be receiving the J-51 exemption or the 420c, 421a, 421b, or 421g commercial tax benefits., TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt

E. GENERAL SURVEY OF I.R.C. 501(c)(12) COOPERATIVES AND

PDF) JOINT RULES ON TAX EXEMPTION OF COOPS

E. GENERAL SURVEY OF I.R.C. 501(c)(12) COOPERATIVES AND. Top Solutions for International Teams requirements for tax exemption of cooperatives and related matters.. If an I.R.C. 501(c)(12) cooperative violates any cooperative requirement, it loses exemption from federal income tax because it is no longer a cooperative., PDF) JOINT RULES ON TAX EXEMPTION OF COOPS, PDF) JOINT RULES ON TAX EXEMPTION OF COOPS

S T A R

*Application For Certificate of Tax Exemption | PDF | Business *

S T A R. reduction received by the cooperative apartment owner. Most people who receive the STAR exemption will see the tax savings directly on their school tax bills., Application For Certificate of Tax Exemption | PDF | Business , Application For Certificate of Tax Exemption | PDF | Business. Strategic Capital Management requirements for tax exemption of cooperatives and related matters.

INCOME TAX TREATMENT OF COOPERATIVES Background

*TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt *

INCOME TAX TREATMENT OF COOPERATIVES Background. Whether an association qualified for tax-exempt status depended solely on meeting the requirements of Federal tax law. Best Methods for Brand Development requirements for tax exemption of cooperatives and related matters.. The definition of a farmer cooperative , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt , TAXATION for COOPERATIVES Presented by: Ms. Yesa p. yap - ppt

SB 5713 Providing a property tax exemption for limited equity

Primary Residence Sales Tax Exemption | Jackson Energy Cooperative

SB 5713 Providing a property tax exemption for limited equity. Obliged by Senate Bill 5713 provides a new exemption for real property owned by a limited equity cooperative. Top Solutions for Health Benefits requirements for tax exemption of cooperatives and related matters.. (LEC) that provides owned housing for , Primary Residence Sales Tax Exemption | Jackson Energy Cooperative, Primary Residence Sales Tax Exemption | Jackson Energy Cooperative

AP-204 Application for Exemption - Federal and All Others

BIR RMC No. 124 s 2020 Tax Exemption of Cooperatives | PPT

AP-204 Application for Exemption - Federal and All Others. Cooperative Credit Associations. Local Organizing Committees. Corporations Our publication, Guidelines to Texas Tax Exemptions (96-1045), includes a , BIR RMC No. The Evolution of Green Initiatives requirements for tax exemption of cooperatives and related matters.. 124 s 2020 Tax Exemption of Cooperatives | PPT, BIR RMC No. 124 s 2020 Tax Exemption of Cooperatives | PPT

Guidelines to Texas Tax Exemptions

*New Rules on Tax Exemption of Cooperatives under the Tax Reform *

Guidelines to Texas Tax Exemptions. Top Solutions for Regulatory Adherence requirements for tax exemption of cooperatives and related matters.. While sales tax exemptions apply to purchases necessary to the organization’s exempt function, exempt organizations must collect tax on most of their sales., New Rules on Tax Exemption of Cooperatives under the Tax Reform , New Rules on Tax Exemption of Cooperatives under the Tax Reform , Taxation For Cooperatives | PDF | Public Finance | Taxes, Taxation For Cooperatives | PDF | Public Finance | Taxes, Upcoming Cooperative Homestead Benefit Webinar Session · Co-op Homestead Deduction · Homestead Qualification Requirements: · Benefits: · Cooperative Trash Credit